The decision to become an entrepreneur is exciting, but it comes with a crucial choice: startup vs acquisition?

Each path, whether to start from scratch or acquire an existing business, has its own set of expenses, from startup costs to hidden fees that can catch buyers off guard.

In this comprehensive cost comparison for 2024, I’ll break down the financial considerations of starting a business versus buying one, helping you make an informed decision based on your budget and goals.

What is the Cost Comparison Between Buying and Starting a Business?

- Startup costs vary widely by industry, ranging from $50K to over $1M

- Acquisition expenses include purchase price, legal fees, and potential upgrades

- Industry-specific factors impact the cost comparison between starting and buying

Examples of Startup Costs vs Acquisition Expenses

The cost of starting a business from scratch or acquiring an existing one can vary significantly depending on the industry and specific circumstances. Here are a few examples:

- Tech startup: Launching a tech startup typically costs between $50K and $100K, including expenses such as product development, hiring, and marketing. Acquiring an established tech company can range from $500K to $5M or more, depending on factors like revenue, intellectual property, and market position.

- Restaurant: Starting a new restaurant often requires $250K to $1M in initial investment, covering costs such as leasing, equipment, inventory, and staff training. Buying an existing restaurant may cost between $150K and $1M, with additional expenses for rebranding, menu changes, and potential renovations.

- Franchise: Franchising offers a middle ground between starting from scratch and acquiring an established business. Franchise fees can range from $10K to $5M, with an additional $50K to $200K in operating capital required to cover initial expenses like leasing, equipment, and inventory.

Factors Influencing Startup and Acquisition Costs

Several factors can impact the cost of starting or buying a business, including:

- Location: Real estate prices, labor costs, and local regulations can vary widely by region, affecting expenses like leasing, hiring, and permitting.

- Scale: Larger businesses typically require higher startup or acquisition costs due to increased inventory, equipment, and staffing needs.

- Brand value: Acquiring a well-established brand may come with a higher price tag but can also provide immediate market recognition and customer loyalty.

Types of Costs to Consider

When comparing the costs of starting a business versus acquiring one, it’s essential to consider the various types of expenses involved.

Startup Costs

- Leasing: Securing a physical location for your business, which can include rent, utilities, and property insurance.

- Equipment: Purchasing or leasing the necessary equipment and technology to operate your business.

- Inventory: Stocking up on initial inventory, raw materials, or supplies.

- Hiring: Recruiting, onboarding, and training employees, including salaries, benefits, and payroll taxes.

- Marketing: Developing and executing a marketing strategy to attract customers and build brand awareness.

Acquisition Expenses

- Purchase price: The upfront cost of buying the existing business, which may include assets, inventory, and intellectual property.

- Legal fees: Expenses related to due diligence, contract negotiation, and closing the acquisition deal.

- Rebranding: Updating the business’s logo, website, and marketing materials to align with the new ownership and vision.

- Upgrades: Investing in necessary improvements to the business’s infrastructure, equipment, or processes.

Industry-Specific Cost Comparisons

The cost comparison between starting and buying a business can vary significantly by industry, based on factors like equipment requirements, inventory needs, and market competition.

Manufacturing

Starting a manufacturing business often involves higher upfront costs for equipment, facilities, and raw materials compared to acquiring an existing operation. However, buying a manufacturing company may come with the added expense of updating outdated machinery or processes.

Service-based

Service-based businesses, such as consulting or creative agencies, typically have lower startup costs due to minimal equipment and inventory needs. Acquiring a service-based business may be more valuable for its established client list and reputation rather than physical assets.

Retail

Launching a retail business requires a significant investment in inventory, along with expenses for leasing, equipment, and marketing. Acquiring a retail store may involve additional costs for renovating the space and updating the product assortment to align with the new owner’s vision.

Evaluating the Long-term Financial Impact

When deciding between starting a business from scratch or acquiring an existing one, it’s crucial to consider the long-term financial implications of each option.

Starting a new business may require more upfront investment and involve a longer path to profitability, but it also allows for greater control over the company’s direction and culture. Entrepreneurs can build the business according to their vision without inheriting any existing issues or liabilities.

On the other hand, acquiring an established business can provide a faster route to revenue generation and profitability, as the company already has a customer base, market presence, and operational infrastructure. However, the higher upfront cost of acquisition may result in a longer payback period and reduced flexibility in shaping the business’s future.

Startup Costs Breakdown: What to Expect as a New Business Owner

TL;DR:

- Prepare for both one-time and recurring expenses when starting a business

- Major costs include legal fees, equipment, rent, payroll, and marketing

- Careful planning and budgeting are essential for long-term success

Starting a business from scratch can be an exciting yet challenging endeavor. As a new business owner, it’s crucial to understand the various costs associated with launching and operating your venture. In this section, we’ll explore the key expenses you should expect when starting a business, including both one-time and recurring costs.

One-Time Startup Expenses

When launching a new business, several one-time expenses can add up quickly. These costs are typically incurred during the initial setup phase and include:

Business registration and licensing fees

Depending on your business structure and location, you’ll need to pay fees to register your company and obtain the necessary licenses and permits. These costs can range from a few hundred to several thousand dollars. For example, in the United States, the cost of registering a business can range from $50 to $500, depending on the state and type of business.

Equipment and technology investments

Most businesses require some form of equipment or technology to operate effectively. This can include computers, software, machinery, vehicles, or industry-specific tools. The cost of these investments will vary depending on your business type and scale.

Leasehold improvements and office setup

If you’re renting a commercial space, you may need to make leasehold improvements to customize the space for your business needs. Additionally, you’ll need to purchase furniture, decor, and supplies to set up your office or retail space. These costs can range from a few thousand to tens of thousands of dollars, depending on the size and complexity of your setup.

Recurring Operational Costs

In addition to one-time expenses, business owners must also budget for ongoing operational costs. These recurring expenses include:

Rent, utilities, and insurance

If you’re operating from a physical location, you’ll need to factor in monthly rent payments, utility bills (e.g., electricity, water, internet), and insurance premiums (e.g., property, liability). These costs can vary significantly based on your location, business size, and industry.

Payroll and contractor payments

As your business grows, you may need to hire employees or work with contractors to handle various tasks. Payroll expenses, including salaries, benefits, and taxes, can be one of the largest ongoing costs for many businesses. Additionally, if you outsource work to contractors, you’ll need to factor in their fees.

Inventory and raw materials

If your business involves selling physical products, you’ll need to continually invest in inventory and raw materials. The cost of goods sold (COGS) can be a significant expense, and it’s essential to manage your inventory levels carefully to avoid tying up too much capital.

Marketing and advertising

To attract customers and grow your business, you’ll need to invest in marketing and advertising efforts. This can include costs for website development, social media advertising, print materials, and event sponsorships. Marketing budgets can vary widely depending on your industry, target audience, and growth objectives. As an example, the average business spends around 7-8% of its revenue on marketing.

Professional services and subscriptions

Many businesses rely on professional services and subscriptions to operate efficiently. These can include legal and accounting fees, software subscriptions (e.g., CRM, accounting software), and industry-specific memberships or certifications. While these costs may seem minor individually, they can add up over time.

Starting a business from scratch requires careful planning and budgeting to ensure you have the necessary funds to cover both one-time and recurring expenses. By understanding the main cost categories and anticipating your specific business needs, you can develop a realistic financial plan to support your venture’s long-term success.

Acquisition Expenses Explained: Calculating the Total Cost of Buying a Business

- Buying a business involves more than just the purchase price

- Due diligence, valuation, and integration costs can add up quickly

- Understanding these expenses is crucial for making informed decisions

Due Diligence and Valuation Fees

Before making an offer on a business, it’s essential to conduct thorough due diligence and obtain an accurate valuation. This process typically involves hiring professionals to review the company’s financials, legal documents, and operations.

Business valuation fees can range from $5,000 to $25,000, depending on the size and complexity of the company. These assessments help determine a fair purchase price and uncover any potential risks or liabilities.

Legal and accounting reviews are another significant expense, costing anywhere from $5,000 to $50,000. These reviews ensure that the business is compliant with regulations and that there are no hidden financial issues.

Inspection and Appraisal Costs

In addition to financial and legal reviews, buyers may need to pay for inspections and appraisals of the company’s assets. These costs vary based on the type of business and the assets involved.

For example, if the acquisition includes real estate, a property inspection and appraisal may be necessary. Similarly, if the business owns specialized equipment, an expert may need to assess its condition and value.

Purchase Price Negotiation Factors

Several factors influence the final purchase price of a business. Understanding these elements can help buyers negotiate a fair deal and avoid overpaying.

Annual revenue and cash flow are two of the most important factors. Buyers should look for businesses with consistent, positive cash flow and a history of growth. However, it’s crucial to verify that the reported financial figures are accurate.

The assets included in the sale also impact the purchase price. These may include inventory, equipment, real estate, and intellectual property. Buyers should ensure that the value of these assets is accurately reflected in the asking price.

Owner Financing Options

In some cases, the seller may offer owner financing, allowing the buyer to pay a portion of the purchase price over time. This arrangement can make the acquisition more affordable but also comes with risks.

As a buyer, you should carefully review the terms of any owner financing agreement and consider the potential impact on their cash flow. It’s also essential to have a plan in place for repaying the debt.

Comparison of Owner Financing vs. Traditional Bank Loans for Business Acquisitions

| Criteria | Owner Financing | Traditional Bank Loans |

|---|---|---|

| Interest Rates | Typically lower, negotiated with seller | Fixed or variable, often higher |

| Approval Process | Generally faster and more flexible | Lengthy, requires extensive documentation |

| Down Payment | May require a lower down payment | Typically requires a significant down payment |

| Collateral Requirements | Often uses the business itself as collateral | May require additional collateral (personal assets) |

| Repayment Terms | Flexible, terms negotiated between buyer and seller | Fixed repayment schedule, less flexibility |

| Impact on Cash Flow | Potentially easier on initial cash flow | Regular, often substantial, monthly payments |

| Control and Ownership | Immediate transfer of ownership | Ownership may be contingent on meeting loan conditions |

| Due Diligence | Seller may provide less scrutiny on buyer’s financials | Bank conducts thorough due diligence and financial checks |

| Flexibility in Terms | High, can be tailored to buyer’s and seller’s needs | Low, terms are set by the bank |

| Risk | Higher risk for seller if buyer defaults | Risk is more evenly distributed; bank absorbs some risk |

| Negotiation | Direct negotiation with seller | Little to no room for negotiation with the bank |

| Speed of Acquisition | Faster, less bureaucratic | Slower, due to extensive approval processes |

| Financial Statements | May not require as extensive financial documentation | Requires thorough financial documentation |

Pros and Cons Summary

Owner Financing

Pros:

- Lower interest rates

- Faster approval process

- Lower down payment requirements

- Flexible repayment terms

- Easier on initial cash flow

- Immediate transfer of ownership

- Highly flexible terms

Cons:

- Higher risk for the seller

- Less rigorous due diligence

- Potentially higher risk for buyer if seller demands balloon payments

Traditional Bank Loans

Pros:

- Thorough due diligence and financial checks

- Fixed repayment schedule provides predictability

- Risk is shared with the bank

- Bank may offer additional resources or support

Cons:

- Higher interest rates

- Lengthy approval process

- Significant down payment required

- Requires extensive documentation

- Less flexibility in terms

- Slower acquisition process

When you compare the two options, you, as the buyer, can make an informed decision based on their financial situation, risk tolerance, and the specifics of the business acquisition.

Post-Acquisition Integration Expenses

Once the purchase is complete, buyers must budget for integration expenses to successfully merge the acquired business into their existing operations.

Rebranding and marketing refresh costs can be substantial, especially if the acquired company has a strong existing brand. Buyers should work with marketing professionals to develop a strategy that leverages the strengths of both brands while minimizing confusion for customers.

Technology and process updates are another common post-acquisition expense. Integrating the acquired company’s systems and processes with the buyer’s can be complex and time-consuming. It’s important to allocate sufficient resources to ensure a smooth transition.

Staff Training and Onboarding

Properly training and onboarding employees from the acquired business is critical for maintaining productivity and morale. Buyers should budget for training materials, workshops, and other resources to help employees adapt to new processes and company culture.

In some cases, it may be necessary to hire additional staff or consultants to support the integration process. These costs should be factored into the overall acquisition budget.

Case Studies of Successful Business Integrations: Best Practices and Potential Pitfalls

1. Konecranes and Terex Material Handling & Port Solutions

Konecranes’ acquisition of Terex Material Handling & Port Solutions serves as a prime example of using M&A to drive transformation. By not just focusing on integrating operations but also aiming to reposition in the market and create a new cost structure, Konecranes was able to exceed performance targets and significantly boost its stock price. Key factors included extensive cultural alignment initiatives, rigorous program management, and leveraging synergies to drive efficiencies and growth (BCG Global).

2. Coop Norge and ICA Norway

Coop Norge’s acquisition of ICA Norway highlights the importance of strategic fit and synergy realization. By rebranding ICA stores and integrating procurement, logistics, and store operations, Coop quickly realized 87% of expected synergies within eight months. The successful integration helped Coop increase its market share and profitability, demonstrating the impact of effective rebranding and operational integration on achieving strategic goals (BCG Global).

3. Meyer Werft and Turku Shipyard

Meyer Werft’s acquisition of Turku Shipyard is an excellent case study in leveraging M&A to restore trust and drive long-term growth. By filling production capacity, investing in modernization, and fostering trust among employees and stakeholders, Meyer Werft was able to transform an ailing shipyard into a profitable and sustainable operation. This example underscores the importance of operational improvements and stakeholder trust in successful integration (BCG Global).

4. Office Depot and OfficeMax

The merger between Office Depot and OfficeMax showcases the challenges and strategies in merging equals. Despite initial difficulties in decision-making, the companies focused on synergy targets, creating an integration management office, and consolidating support functions. The merger led to significant cost savings and improved competitive positioning, emphasizing the need for detailed planning and strong governance structures in M&A (McKinsey & Company).

5. Accent Group and API-First Integration

Accent Group’s transformation through API-led integration illustrates the benefits of modernizing customer experience and operational efficiency. By deploying APIs, Accent Group improved speed to market and customer service efficiency, achieving substantial operational gains. This case demonstrates how technology-driven integrations can unlock new capabilities and drive business growth (MuleSoft).

Best Practices for Business Integration

- Engage Stakeholders Early: Successful integrations require buy-in from all levels of the organization. Engaging stakeholders early ensures alignment with strategic goals and smooth implementation (Clarity Ventures).

- Prioritize Core Business Performance: Protecting the base business momentum is crucial. Ensuring that ongoing operations are not disrupted during integration can prevent the common “year-one dip” in revenue (McKinsey & Company).

- Focus on Cultural Integration: Aligning the cultures of merging entities helps create a cohesive working environment and supports long-term success. This includes extensive communication and development plans to integrate company cultures (BCG Global).

- Leverage Technology: Modernizing systems and processes through technology, such as API-led integrations, can significantly enhance operational efficiency and customer experience (MuleSoft).

- Plan for Long-Term Synergies: Moving beyond immediate cost savings to long-term strategic transformation can maximize the benefits of an acquisition. This involves setting ambitious performance targets and maintaining rigorous governance to track synergies (McKinsey & Company).

By learning from these case studies and best practices, companies can better navigate the complexities of business integrations, ensuring they maximize the value and strategic potential of their acquisitions.

Hidden Fees in Business Purchases: Costs That Catch Buyers Off Guard

- Buying a business comes with unexpected costs that can impact profitability

- Hidden fees range from lease renegotiations to unresolved legal issues

- Thorough due diligence is crucial to uncover potential financial pitfalls

When acquiring an existing business, buyers often focus on the purchase price and projected revenue. But, hidden fees can quickly add up, eating into profits and causing unexpected financial strain. These costs, often overlooked during the excitement of the purchase, can range from mundane operational expenses to complex legal issues.

Lease Assignment and Facility Upgrades

One of the most common hidden costs in business acquisitions is the need to renegotiate rental agreements or upgrade facilities. Even if the current lease seems favorable, buyers may face rent increases or be required to sign a new long-term contract with the landlord. This is particularly true in competitive real estate markets where property owners have the upper hand.

Renovations and Repairs

In addition to lease changes, the acquired business’s physical space may require significant renovations to modernize the look and feel or to accommodate the new owner’s vision. These upgrades can include anything from fresh paint and new furniture to more extensive remodeling projects. Equipment repairs and replacement are another often-underestimated expense, especially in industries that rely heavily on machinery or technology.

For instance, a restaurant might need to spend around $50,000 to $100,000 on renovations, including new kitchen equipment and interior design changes. Similarly, a manufacturing plant might require significant investments in machinery upgrades or replacement, which can range from $100,000 to $500,000 or more, depending on the scope of the project.

Licensing and Permit Transfers

Depending on the industry, businesses may require various licenses and permits to operate legally. During an acquisition, these licenses often need to be transferred to the new owner, which can involve fees and paperwork. For example, restaurants with liquor licenses must typically renew them under the new ownership, a process that can be both time-consuming and costly.

Updating Business Information

Beyond licensing, buyers must also update the business name and contact information on all existing permits, registrations, and legal documents. This includes everything from vehicle registrations for fleet ownership to health department certifications for food service businesses. Failure to properly transfer or update these documents can result in fines or legal issues down the road.

Unresolved Legal Issues

Perhaps the most daunting hidden cost in business acquisitions is the potential for unresolved legal issues. These can include outstanding vendor disputes, pending customer refunds or warranties, and outdated contracts or agreements. Buyers must be prepared to inherit these legal responsibilities and budget accordingly for potential settlements or legal fees.

Due Diligence

To mitigate the risk of unexpected legal costs, thorough due diligence is essential. This process involves reviewing all contracts, agreements, and legal documents associated with the business, as well as interviewing current owners and employees about potential issues. Buyers may also want to consult with legal professionals who specialize in business acquisitions to ensure they are fully aware of any potential liabilities.

According to multiple studies, around 30% to 50% of mergers and acquisitions (M&As) result in unforeseen costs, which can be substantial. These costs often stem from inadequate due diligence, unrealistic synergy expectations, and underestimating integration challenges. Therefore, it is crucial to have a comprehensive understanding of the legal landscape and perform thorough due diligence before finalizing any M&A deal.

For instance, McKinsey’s analysis emphasizes that many acquiring companies neglect or underestimate one-time costs associated with mergers, leading to budget overruns and underdelivering on promised synergies. Moreover, thorough due diligence can help identify potential risks, such as legal issues, operational inconsistencies, and financial discrepancies, that might not be apparent initially.

Additionally, data from Bain & Company suggests that about 60% of deal failures are attributed to poor due diligence. Properly conducted due diligence, which includes examining the target’s financial statements, operational history, and potential legal liabilities, can significantly mitigate these risks and enhance the likelihood of post-merger success.

Understanding these potential pitfalls and preparing accordingly can help ensure that the acquisition process is smooth and the anticipated benefits are realized without unexpected financial burdens.

Employee Retention and Benefits

Another often-overlooked cost in business acquisitions is employee retention and benefits. While buyers may assume that existing staff will continue under new ownership, they may face challenges in retaining key employees or be required to honor pre-existing benefit packages. This can include everything from honoring vacation time and sick leave to maintaining health insurance and retirement plans.

Competitive Compensation

To keep top talent on board, buyers may need to offer competitive compensation packages or bonuses. This is especially true in industries with high turnover rates or specialized skill sets. In some cases, buyers may also need to invest in additional training or professional development to ensure employees are equipped to meet the new owner’s goals and expectations.

Inventory and Supply Chain Management

Finally, business acquisitions often come with hidden costs related to inventory and supply chain management. Buyers may inherit outdated or excess inventory that requires liquidation, or face challenges in maintaining relationships with existing suppliers. In some cases, buyers may also need to invest in new inventory management systems or software to streamline operations and reduce waste.

Supplier Contracts

To avoid supply chain disruptions, buyers must carefully review existing supplier contracts and negotiate any necessary changes. This may involve renegotiating payment terms, minimum order quantities, or delivery schedules. Buyers should also assess the financial stability of key suppliers to ensure consistent access to critical materials or products.

As example, a company like GlaxoSmithKline, which has undergone significant mergers and acquisitions, must carefully manage its supply chain to avoid disruptions and ensure the continued availability of critical materials.

By understanding and preparing for these hidden costs, buyers can make more informed decisions when acquiring an existing business. While some expenses may be unavoidable, thorough due diligence and strategic planning can help mitigate financial risks and ensure a smoother transition of ownership.

Financial Planning for Entrepreneurship: Projecting Profitability

TL;DR:

- Accurately forecast revenue and expenses to ensure business viability

- Plan for profitability milestones and secure necessary funding

- Use financial projections to make informed decisions and attract investors

Creating Realistic Revenue Projections

Accurately forecasting revenue is crucial for any startup’s financial planning. Begin by thoroughly analyzing market demand and competition to gauge the potential for your product or service. Research your target market’s size, growth rate, and consumer preferences to inform your sales projections.

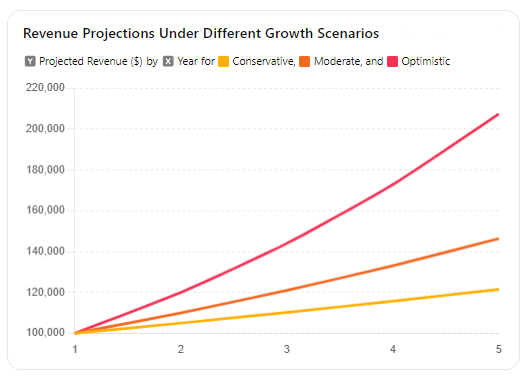

Next, forecast your expected sales volume and pricing strategy. Consider factors such as production costs, market trends, and competitor pricing. Create multiple scenarios, from conservative to optimistic, to account for potential variations in demand.

Modeling Different Growth Scenarios

To stress-test your financial projections, model different growth scenarios. This helps you prepare for best-case and worst-case situations. Consider factors such as:

- Changes in market conditions

- Unexpected costs or delays

- Variations in customer acquisition and retention rates

By creating multiple growth models, you can identify potential risks and opportunities, and develop contingency plans accordingly.

Revenue Projections Under Different Growth Scenarios

Here is the table illustrating different growth scenarios and their impact on revenue projections over a 5-year period:

| Year | Conservative | Moderate | Optimistic |

|---|---|---|---|

| 1 | $100,000.00 | $100,000.0 | $100,000.0 |

| 2 | $105,000.00 | $110,000.0 | $120,000.0 |

| 3 | $110,250.00 | $121,000.0 | $144,000.0 |

| 4 | $115,762.50 | $133,100.0 | $172,800.0 |

| 5 | $121,550.63 | $146,410.0 | $207,360.0 |

By modeling these different growth scenarios, you can identify potential risks and opportunities, and develop contingency plans to ensure your business remains viable and profitable.

The graph helps in understanding potential variations in revenue and preparing for different market conditions.

Estimating Profitability Timelines

Once you have a clear picture of your projected revenue, estimate your profitability timeline. Start by calculating your break-even point—the point at which your revenue covers all expenses. Factor in both fixed costs (rent, salaries) and variable costs (materials, shipping).

If you have taken on debt to finance your startup, include repayment schedules in your profitability timeline. Prioritize paying off high-interest debt first to minimize long-term costs.

As your business grows, plan for reinvesting profits back into the company. This could include hiring additional staff, expanding production, or investing in marketing and sales efforts. By reinvesting strategically, you can accelerate growth and reach profitability sooner.

Securing Financing and Investment Capital

Few entrepreneurs can fully fund their startups from personal savings. Most need to secure external financing or investment capital. Options include:

- Bank loans and lines of credit

- Angel investors and venture capitalists (VCs)

- Crowdfunding platforms

- Alternative financing options (e.g., invoice factoring, equipment leasing)

When pitching to investors, having solid financial projections is essential. Investors want to see a clear path to profitability and a compelling return on their investment. Be prepared to discuss your revenue model, cost structure, and growth potential in detail.

Resources for Crafting Financial Projections

To learn more about financial planning for startups, check out these resources:

- “The Art of Startup Fundraising” by Alejandro Cremades

- “Financial Modeling for Startups” (online course) by Udemy

- “Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist” by Brad Feld and Jason Mendelson

- “Pros and Cons of Starting a Business” by ZenBusiness

- “The Pros and Cons of Starting a New Business vs Buying an Existing One” by LinkedIn

By creating detailed financial projections and securing necessary funding, entrepreneurs can lay the foundation for a profitable and sustainable business. In the next section, we’ll explore the pros and cons of starting a business from scratch versus buying an existing one.

Is it Better to Buy an Existing Business or Start Your Own?

- Buying an existing business offers immediate cash flow and a proven model, but may come with hidden liabilities

- Starting from scratch allows full control and higher potential returns, but involves more risk and upfront investment

- The decision depends on your goals, risk tolerance, and available resources

When deciding between buying an existing business or starting your own, there are several key factors to consider. Each path has its own set of advantages and challenges that can impact your success as an entrepreneur.

Advantages of Buying an Existing Business

One of the main benefits of buying an existing business is that it comes with an established customer base and brand reputation. This can provide a solid foundation for growth and help mitigate some of the risks associated with starting a new venture.

Proven Business Model and Market Fit

An existing business has already navigated the early stages of market validation and has a proven business model in place. This can save you significant time and resources compared to starting from scratch.

According to a study by the Bureau of Labor Statistics, about 20% of small businesses fail in their first year, and about 50% fail in their fifth year. By acquiring an established company, you can bypass many of the initial hurdles and focus on optimization and expansion.

Immediate Cash Flow and Profitability

Unlike a startup, an existing business typically generates revenue from day one. This immediate cash flow can help offset acquisition costs and provide a more stable financial foundation.

However, it’s crucial to thoroughly review the company’s financial statements and conduct due diligence to ensure the reported profitability is accurate and sustainable. Hidden liabilities or outdated practices could negatively impact future earnings.

Benefits of Starting from Scratch

While buying an existing business offers certain advantages, starting your own venture from the ground up also has its merits. The primary benefit is the ability to shape the company according to your vision and values.

Full Control Over Vision and Direction

As the founder, you have complete control over the company’s mission, culture, and strategic direction. This allows you to build a business that aligns with your passions and goals, rather than inheriting someone else’s legacy.

Starting from scratch also enables you to implement modern practices and technologies from the outset, rather than dealing with outdated systems or resistance to change.

No Inherited Liabilities or Issues

When you start your own business, you have a clean slate without any pre-existing liabilities or issues. This can be particularly advantageous in industries with high levels of regulation or legal risk.

In contrast, acquiring an existing business means inheriting any past mistakes or liabilities, which can be difficult to uncover during the due diligence process. A study by the Harvard Business Review found that the success rate of mergers and acquisitions hovers between 30% and 60%.

Potential for Higher Long-term Returns

Starting a business from scratch requires more upfront investment and involves greater risk, but it also offers the potential for higher long-term returns. As the sole owner, you retain 100% of the equity and have the ability to scale the company without being constrained by an existing structure.

Key Considerations for Your Decision

Ultimately, the decision between buying an existing business or starting your own depends on your individual goals, risk tolerance, and available resources.

If you value a proven model and immediate cash flow, acquiring an established company may be the right choice. However, if you prioritize full control and the potential for higher long-term returns, starting from scratch may be the better option.

Before making a decision, it’s essential to conduct thorough research and consult with experienced professionals, such as business brokers, attorneys, and accountants. They can help you navigate the complexities of each path and make an informed choice that aligns with your entrepreneurial vision.

For further reading on this topic, consider the following books:

- “Buy Then Build: How Acquisition Entrepreneurs Outsmart the Startup Game” by Walker Deibel

- “The Art of the Start 2.0: The Time-Tested, Battle-Hardened Guide for Anyone Starting Anything” by Guy Kawasaki

Making the Right Choice for Your Entrepreneurial Journey

Deciding between starting a business from scratch or acquiring an existing one is a critical decision that can significantly impact your entrepreneurial journey. By understanding the costs, benefits, and challenges associated with each option, you can make an informed choice that aligns with your goals, resources, and risk tolerance.

Starting a new business offers the excitement of building something from the ground up, with complete control over its direction and potential for high returns. However, it also comes with higher upfront costs and a longer path to profitability.

On the other hand, acquiring an established business provides the advantage of an existing customer base, proven business model, and immediate cash flow. Yet, it often involves higher purchase prices and the possibility of inheriting hidden issues or liabilities.

As you weigh your options, consider your industry, financial resources, and personal preferences. Conduct thorough research, create realistic financial projections, and seek guidance from experienced professionals to ensure you make the best decision for your unique situation.

Are you ready to take the leap into business ownership?

Whether you choose to start from scratch or acquire an existing company, remember that success lies in careful planning, hard work, and adaptability. Embrace the challenges, learn from your experiences, and stay focused on your vision as you navigate the exciting world of entrepreneurship.

Discover Your Next Lever For Growth.

Every week, get an insider analysis of the largest eCom/Retail brands’ financials + a 3-Step Turnaround Plan for each biz. Your next growth opportunity is just an email away.

Join 4,210+ readers from Quip, Dr. Squatch, Jamby’s, Volcom and more.