Buying a home is a major milestone, but what if traditional financing isn’t an option? Enter owner financing: a powerful tool that can help buyers achieve their homeownership dreams and sellers close deals faster.

In this comprehensive guide, we’ll demystify owner financing, covering everything from the basics to the benefits, pros and cons, and alternatives. Whether you’re a buyer struggling to secure a mortgage or a seller looking to expand your pool of potential buyers, this article is your one-stop shop for mastering owner financing in 2024.

Get ready to discover how owner financing can transform the way you buy or sell real estate – no bank required.

What is Owner Financing?

- Owner financing allows buyers to purchase property directly from the seller

- The seller acts as the lender, providing financing for the buyer

- Buyers make monthly payments to the seller until the loan is paid off

Owner financing, also known as seller financing, is a transaction where the property seller acts as the lender, allowing the buyer to purchase the property with a down payment and make monthly payments directly to the seller until the loan is paid off. This type of financing can be an attractive option for both buyers and sellers in certain situations.

For buyers, owner financing can provide an opportunity to purchase a property when traditional financing through a bank or mortgage lender is not available or desirable. This may be due to credit issues, self-employment, or other factors that make it difficult to qualify for a conventional mortgage.

Sellers may choose to offer owner financing as a way to attract a larger pool of potential buyers and facilitate a faster sale. It can also provide a steady stream of income for the seller over the term of the loan.

Example of Owner Financing

To illustrate how owner financing works, consider the following example:

- A seller agrees to finance $200,000 of a $250,000 property

- The buyer puts down a $50,000 down payment and makes monthly payments to the seller based on the agreed-upon terms

- The seller receives regular monthly payments, which include principal and interest, until the loan is fully paid off

The specific terms of the owner financing agreement, such as the interest rate, loan term, and payment schedule, are negotiated between the buyer and seller.

Types of Owner Financing Agreements

There are two primary types of owner financing agreements: promissory note and mortgage, and land contract (also known as a contract for deed).

Promissory Note and Mortgage

A promissory note and mortgage is the most common type of owner financing agreement. In this arrangement, the buyer signs a promissory note agreeing to repay the loan provided by the seller. The mortgage secures the property as collateral, giving the seller the right to foreclose on the property if the buyer defaults on the loan.

This type of agreement closely resembles a traditional mortgage, with the key difference being that the seller acts as the lender instead of a bank or financial institution.

Land Contract (Contract for Deed)

A land contract, also known as a contract for deed, is an alternative owner financing arrangement where the seller retains legal title to the property until the loan is fully paid off. The buyer makes payments to the seller and has equitable title, which grants them the right to use and occupy the property.

Under a land contract, the seller has the right to cancel the contract and retake possession of the property if the buyer defaults on the loan. This type of agreement may be riskier for buyers, as they do not gain legal title to the property until the loan is fully repaid.

Disadvantages and Risks of Owner Financing

While owner financing can be beneficial for both buyers and sellers, there are some potential disadvantages and risks to consider:

- Higher interest rates: Sellers may charge higher interest rates than traditional lenders to compensate for the added risk of financing the purchase.

- Balloon payments: Some owner financing agreements may include a balloon payment, requiring the buyer to pay off the remaining loan balance in a lump sum after a certain period. This can be challenging for buyers if they are unable to secure alternative financing.

- Due-on-sale clauses: If the seller has an existing mortgage on the property, the lender may have a due-on-sale clause that requires the loan to be paid off if the property is sold. This can complicate owner financing arrangements.

- Seller default: If the seller has financial difficulties or declares bankruptcy, it could put the buyer’s investment at risk.

Common Owner Financing Terms

The terms of an owner financing agreement can vary widely depending on the needs and preferences of the buyer and seller. However, some common owner financing terms include:

- Down payment: Typically ranges from 5% to 20% of the purchase price

- Interest rate: Often higher than traditional mortgage rates, ranging from 6% to 10% or more

- Loan term: Usually shorter than traditional mortgages, ranging from 5 to 15 years

- Balloon payment: May be required after a certain period, such as 5 or 10 years

It’s essential for both buyers and sellers to carefully review and negotiate the terms of an owner financing agreement to ensure that it meets their needs and protects their interests. Consulting with a real estate attorney or financial advisor can help navigate the complexities of owner financing and make informed decisions.

The Owner Financing Process

- Understand the step-by-step process of owner financing

- Learn how to structure the deal and protect both buyer and seller

- Discover the tax implications and legal considerations

Owner financing can be a powerful tool for both buyers and sellers, but it’s essential to understand the process and potential pitfalls. In this section, we’ll walk you through the steps involved in an owner-financed transaction, from determining the purchase price to closing the deal and making payments.

Determine the Purchase Price and Down Payment

The first step in the owner financing process is to agree on a fair market value for the property. This can be done by reviewing recent sales of similar properties in the area and considering any unique features or improvements. Once a price is agreed upon, the buyer and seller must determine the down payment amount, which is typically 10-20% of the purchase price.

Factors to Consider When Setting the Purchase Price

- Current market conditions and demand for the property

- The property’s condition and any necessary repairs or upgrades

- The seller’s motivation and timeline for selling

- The buyer’s financial situation and ability to make payments

Draft the Owner Financing Contract

With the purchase price and down payment established, it’s time to draft the owner financing contract. This document should include all the terms of the agreement, such as the interest rate, loan duration, and payment frequency. It’s crucial to specify any balloon payments or prepayment penalties and to consult with a real estate attorney to ensure legal compliance.

Key Components of an Owner Financing Contract

- Interest rate and whether it’s fixed or adjustable

- Loan term (typically 5-30 years)

- Monthly payment amount and due date

- Late payment penalties and default provisions

- Balloon payments and prepayment options

- Maintenance and repair responsibilities

Conduct Due Diligence

Before finalizing the deal, both parties must conduct due diligence. The seller should perform a title search to ensure a clear title, while the buyer should obtain an appraisal to verify the property’s value. The buyer should also review their credit and financial ability to make payments, as defaulting on an owner-financed loan can have serious consequences.

Buyer’s Due Diligence Checklist

- Obtain a professional home inspection

- Review the property’s title and any outstanding liens

- Verify zoning and land use restrictions

- Assess the property’s insurability and potential hazards

- Confirm the seller’s right to offer owner financing

Close the Deal and Begin Payments

Once all due diligence is complete, and both parties are satisfied with the terms, it’s time to close the deal. The buyer and seller will sign the promissory note, mortgage, or land contract, and the buyer will make the down payment. From this point forward, the buyer will make monthly payments directly to the seller, who will report the interest income on their tax returns.

Tax Implications of Owner Financing

- Sellers must report interest income on their tax returns

- Buyers may be able to deduct mortgage interest payments

- Sellers may be able to defer capital gains taxes through installment sale treatment

- Consult with a tax professional to understand the specific implications for your situation

By following these steps and seeking professional guidance when needed, buyers and sellers can successfully navigate the owner financing process. While there are potential risks and challenges, owner financing can be a win-win solution for both parties when structured properly.

Benefits of Owner Financing

- Sellers can receive a steady income stream and potentially sell their property faster

- Buyers may have an easier time qualifying for owner financing compared to traditional loans

- Both parties can enjoy more flexibility in negotiating terms that suit their needs

Owner financing offers several advantages for both sellers and buyers. By understanding these benefits, you can determine if this alternative financing method is the right choice for your real estate transaction.

Advantages for Sellers

For sellers, owner financing can provide a reliable source of income over an extended period. Instead of receiving a lump sum from a traditional sale, the seller receives monthly payments that include principal and interest. This steady cash flow can be particularly appealing for sellers who are looking for a consistent income stream in their retirement years. For instance, sellers can earn better rates on their investment compared to traditional investments.

Additionally, offering owner financing can help sellers attract a wider pool of potential buyers. Some buyers may not qualify for a conventional mortgage due to credit issues, self-employment, or other factors. By providing an alternative financing option, sellers can tap into this market and potentially sell their property faster. This is especially beneficial for sellers who want to avoid the lengthy mortgage process and close the sale quickly.

Another advantage for sellers is the ability to charge a higher interest rate than what traditional lenders offer. As the seller is assuming the role of the lender, they can set an interest rate that compensates them for the risk they are taking on. This higher interest rate can result in a greater overall return on their investment. For example, sellers can potentially earn more money than they would through a traditional sale, as they can negotiate better terms and avoid agent commissions.

Advantages for Buyers

For buyers, one of the most significant benefits of owner financing is the potential to purchase a property with less stringent credit requirements. Traditional lenders often have strict guidelines when it comes to credit scores, debt-to-income ratios, and other financial factors. With owner financing, the seller has more flexibility in determining whether a buyer is qualified. This can be particularly helpful for buyers who have poor credit or are self-employed, as they may not meet the strict requirements of traditional lenders.

Another advantage for buyers is the potential for lower closing costs and a faster closing process. In a conventional mortgage, buyers often face a variety of fees, such as appraisal fees, origination fees, and mortgage insurance premiums. With owner financing, many of these costs can be avoided or negotiated with the seller. Additionally, since the transaction is directly between the buyer and seller, the closing process can be streamlined and completed more quickly.

Owner financing also allows for greater flexibility in negotiating loan terms. Buyers and sellers can work together to determine the down payment amount, interest rate, repayment period, and other key aspects of the loan. This flexibility can be especially beneficial for buyers who may not fit into the rigid criteria set by traditional lenders. For example, buyers can negotiate a lower down payment or more flexible repayment terms, making homeownership more accessible.

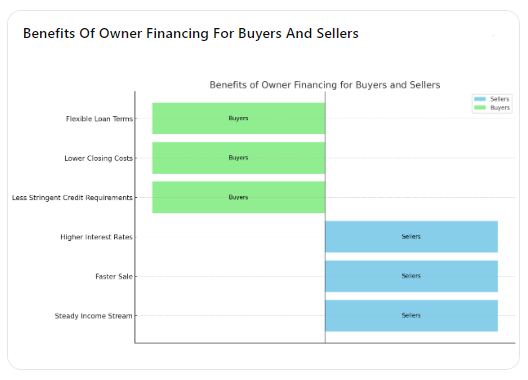

Here is the table and infographic that visually compares the benefits of owner financing for both buyers and sellers:

Table: Benefits of Owner Financing for Buyers and Sellers

| Benefit | Sellers | Buyers |

|---|---|---|

| Steady Income Stream | Provides reliable monthly income | |

| Faster Sale | Attracts more potential buyers, speeds up sale | |

| Higher Interest Rates | Can set higher interest rates for greater return | |

| Less Stringent Credit Requirements | Easier qualification process | |

| Lower Closing Costs | Potentially lower fees, quicker closing | |

| Flexible Loan Terms | Negotiate terms that suit their needs |

Infographic: Benefits of Owner Financing for Buyers and Sellers

The infographic shows the benefits of owner financing from both perspectives:

- Sellers:

- Steady Income Stream: Provides reliable monthly income.

- Faster Sale: Attracts more potential buyers, speeds up sale.

- Higher Interest Rates: Can set higher interest rates for greater return.

- Buyers:

- Less Stringent Credit Requirements: Easier qualification process.

- Lower Closing Costs: Potentially lower fees, quicker closing.

- Flexible Loan Terms: Negotiate terms that suit their needs.

By understanding the advantages of owner financing for both parties, buyers and sellers can make informed decisions about whether this financing method aligns with their goals and circumstances. While owner financing can offer several benefits, it’s essential to also consider the potential drawbacks and risks associated with this arrangement.

Owner Financing Pros and Cons

- Sellers can earn higher returns and sell faster, but risk buyer defaults

- Buyers can purchase without traditional financing, but may face higher rates

- Flexible terms benefit both parties, but less oversight than traditional lending

Pros of Owner Financing

Allows buyers to purchase when traditional financing is unavailable

Owner financing opens doors for buyers who may not qualify for conventional mortgages due to credit issues, self-employment, or other factors. This arrangement allows sellers to expand their pool of potential buyers and close deals faster.

According to a 2023 study by the National Association of Realtors, 22% of home sales were financed through non-traditional means, including owner financing, highlighting its prevalence in the market.

Sellers can potentially earn higher returns

By acting as the lender, sellers can charge interest rates higher than current market rates, resulting in a greater return on their investment over time. For example, if market rates are 4%, a seller could charge 6% and earn an additional 2% on the loan.

However, sellers must weigh the potential for higher returns against the increased risk of buyer default. Thorough due diligence and a well-structured contract can help mitigate this risk.

Flexible terms can be tailored to both parties’ needs

Owner financing allows buyers and sellers to negotiate terms that work best for their unique situations. This may include adjustable interest rates, balloon payments, or longer repayment periods.

For instance, a seller may agree to a 5-year term with a balloon payment, allowing the buyer time to improve their credit and qualify for traditional refinancing. This flexibility benefits both parties and can facilitate transactions that otherwise might not occur.

Cons of Owner Financing

Sellers take on the risk of buyer default

One of the primary drawbacks of owner financing is the seller’s assumption of risk. If the buyer fails to make payments, the seller may need to initiate foreclosure proceedings, which can be costly and time-consuming.

To minimize this risk, sellers should thoroughly vet potential buyers, including credit checks, employment verification, and references. Requiring a substantial down payment can also provide a buffer against default.

Buyers may face higher interest rates and balloon payments

While owner financing can be more accessible than traditional mortgages, buyers may face higher interest rates and less favorable terms. Sellers, acting as lenders, may charge rates above market average to compensate for the increased risk.

Additionally, many owner financing agreements include balloon payments, requiring the buyer to pay off the remaining balance in a lump sum after a set period. Buyers must be prepared for this obligation and have a plan in place to secure financing or sell the property before the balloon payment is due.

Less government oversight and consumer protections

Owner financing transactions are subject to fewer regulations and consumer protections than traditional mortgage lending. This can create potential risks for both buyers and sellers.

For example, the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA) may not apply to owner financing deals, depending on the seller’s financing volume. These laws typically require lenders to provide specific disclosures and follow certain procedures to protect consumers.

To navigate these complexities, buyers and sellers should consult with experienced real estate attorneys and financial advisors. Proper guidance can help ensure a fair and legally sound transaction for all parties involved.

Weighing the Pros and Cons

Ultimately, the decision to pursue owner financing depends on the unique circumstances and goals of both the buyer and seller. While this arrangement offers several benefits, such as flexibility and accessibility, it also comes with inherent risks and potential drawbacks.

Before entering into an owner financing agreement, both parties should thoroughly assess their financial situations, long-term objectives, and risk tolerance. By carefully weighing the pros and cons and seeking professional advice, buyers and sellers can determine if owner financing is the right path forward.

For a deeper understanding of owner financing and its implications, consider the following resources:

- “The Complete Guide to Owner Financing” by Benny Kass

- “The Owner Financing Bible” by Richard Allen

- “Seller Financing on Steroids” by Peter Fortunato

These books provide detailed insights, case studies, and strategies for successfully navigating owner financing transactions.

Owner Financing Alternatives

- Explore other options for buyers and sellers when traditional financing isn’t feasible

- Learn about rent-to-own, lease-purchase agreements, and other creative financing methods

- Understand the benefits and drawbacks of each alternative financing option

When owner financing isn’t the right fit for a buyer or seller, there are several other alternative financing options to consider. These methods can help facilitate a real estate transaction when traditional mortgage financing isn’t available or desirable.

Rent-to-Own Agreements

In a rent-to-own agreement, the buyer rents the property from the seller with the option to purchase it at a later date, typically within a specified timeframe (e.g., 1-3 years). A portion of the monthly rent payments may be applied towards the eventual purchase price, allowing the buyer to build equity over time.

Benefits of rent-to-own agreements for buyers include:

- Opportunity to build equity while renting

- More time to improve credit scores or save for a down payment

- Ability to “test drive” the property before committing to a purchase

For sellers, rent-to-own agreements can:

- Provide a steady income stream from rental payments

- Attract a wider pool of potential buyers

- Offer the potential for a higher sales price due to the rent credit

However, rent-to-own agreements also come with some risks. Buyers may forfeit their rent credit and option fee if they decide not to purchase the property or fail to secure financing. Sellers may face challenges if the buyer defaults on rent payments or damages the property during the rental period.

Lease-Purchase Agreements

Lease-purchase agreements are similar to rent-to-own arrangements but with a key difference: the buyer is contractually obligated to purchase the property at the end of the lease term. The buyer pays an upfront option fee and agrees to a purchase price, which is typically set at the start of the lease.

Advantages of lease-purchase agreements include:

- Seller has a guaranteed buyer at the end of the lease term

- Buyer can lock in a purchase price and build equity through rental payments

- Allows time for the buyer to improve their financial situation before obtaining a mortgage

Drawbacks of lease-purchase agreements:

- Buyer may lose option fee and rent credit if unable to secure financing

- Seller may face legal issues if buyer fails to fulfill purchase obligation

- Property value may fluctuate during the lease term, potentially benefiting or harming either party

Traditional Mortgage Financing

While owner financing and its alternatives can be useful in certain situations, traditional mortgage financing remains the most common way to purchase a home. Buyers obtain a loan from a bank, credit union, or other lender, which typically requires a higher credit score and more stringent qualifications compared to alternative financing methods.

Benefits of traditional mortgage financing:

- Lower interest rates compared to alternative financing options

- Longer repayment terms (e.g., 30-year fixed-rate mortgages)

- Potential for tax deductions on mortgage interest payments

- Established legal protections for buyers and lenders

Drawbacks of traditional mortgage financing:

- Strict qualification requirements (credit score, debt-to-income ratio, etc.)

- Lengthy application and approval process

- Higher upfront costs (down payment, closing costs, etc.)

- Potential for foreclosure if the buyer defaults on payments

For buyers who qualify, traditional mortgage financing often provides the most stable and cost-effective path to homeownership. However, alternative financing options like owner financing, rent-to-own, and lease-purchase agreements can be valuable tools when conventional mortgages are not an option.

Seller Financing Through Land Contracts

Another alternative to owner financing is a land contract, also known as a contract for deed or bond for deed. In this arrangement, the seller retains legal title to the property while the buyer makes monthly payments directly to the seller until the purchase price is paid in full.

Advantages of land contracts for buyers:

- Lower upfront costs compared to traditional mortgages

- Flexible qualification requirements

- Opportunity to build equity over time

For sellers, land contracts can:

- Provide a steady income stream from buyer payments

- Offer a faster and less expensive way to sell a property

- Allow the seller to retain control of the property until the contract is fulfilled

However, land contracts also have some potential drawbacks:

- Buyer does not gain legal title to the property until the contract is fully paid

- Seller may face challenges if the buyer defaults on payments

- Limited legal protections for buyers compared to traditional mortgages

Exploring Creative Financing Options

In addition to the alternative financing methods discussed above, buyers and sellers may explore other creative financing options tailored to their specific needs and circumstances. Some examples include:

- Assuming an existing mortgage: The buyer takes over the seller’s current mortgage, often with little or no change to the terms.

- Wraparound mortgage: The seller offers a new mortgage that includes the existing mortgage balance, allowing the buyer to make payments directly to the seller.

- Equity sharing: The buyer and seller agree to share ownership of the property, with the buyer occupying the home and the seller receiving a portion of the equity appreciation.

When considering creative financing options, it’s essential for both buyers and sellers to:

- Thoroughly research the legal and financial implications of each option

- Consult with experienced real estate professionals, including attorneys and financial advisors

- Carefully assess the risks and benefits of each financing method based on their unique situation

By understanding the various owner financing alternatives available, buyers and sellers can make informed decisions and find the best financing solution for their real estate transaction.

Owner Financing Contracts

TL;DR:

- An owner financing contract outlines the terms of the seller-financed loan

- Essential elements include purchase price, interest rate, and payment terms

- Work with a real estate attorney to ensure legal compliance

Essential Elements of an Owner Financing Contract

An owner financing contract, also known as a land contract or contract for deed, is a legal agreement that outlines the terms and conditions of the seller-financed loan. This contract is crucial for protecting the interests of both the buyer and the seller.

The most critical elements of an owner financing contract include:

- Purchase price: The total amount the buyer agrees to pay for the property

- Down payment: The initial payment made by the buyer at closing

- Loan amount: The remaining balance financed by the seller

- Interest rate: The annual percentage rate charged on the loan

- Loan term: The duration of the loan, typically ranging from 5 to 30 years

- Payment frequency: Whether payments are made monthly, quarterly, or annually

- Late payment penalties: Consequences for the buyer if payments are not made on time

- Default provisions: Actions the seller can take if the buyer fails to fulfill their obligations

- Property maintenance: The buyer’s responsibilities for maintaining the property

- Insurance requirements: The type and amount of insurance the buyer must carry

Balancing Buyer and Seller Interests

When drafting an owner financing contract, it’s essential to strike a balance between the needs of the buyer and the seller. The buyer seeks affordable financing and the opportunity to build equity, while the seller wants to ensure a steady income stream and protect their investment.

| Buyer Interests | Seller Interests |

|---|---|

| Affordable financing | Steady income stream |

| Building equity | Protecting investment |

| Flexibility in payment terms | Ensuring timely payments |

Drafting the Contract

Creating a legally sound and comprehensive owner financing contract is not a task to be taken lightly. Mistakes or omissions can lead to costly disputes down the road. Here are the steps to drafting a solid contract:

- Work with a real estate attorney: Engage an attorney experienced in owner financing to draft or review the contract. They can ensure that the agreement complies with state and federal laws, such as the Dodd-Frank Act, which imposes specific requirements on seller-financed transactions.

- Clearly define the terms: Specify all the essential elements of the loan, as discussed earlier. Leave no room for ambiguity or misinterpretation.

- Address property condition: Include provisions related to the property’s condition at the time of sale and the buyer’s responsibilities for maintenance and repairs.

- Plan for contingencies: Consider potential scenarios, such as the buyer wanting to sell the property or refinance the loan, and include provisions to address these situations.

- Specify remedies for default: Clearly outline the actions the seller can take if the buyer defaults on the loan, such as foreclosure or accelerating the loan balance.

The Importance of Legal Counsel

While templates for owner financing contracts are available online, it’s crucial to have an attorney tailor the agreement to your specific situation. Each state has its own laws governing real estate transactions, and a one-size-fits-all approach can lead to unintended consequences.

An experienced attorney can help navigate complex issues, such as title transfer, escrow arrangements, and figure out who pays property tax on owner financing. They can also advise on ways to structure the transaction to minimize risk and maximize benefits for both parties.

Recording the Contract

Once the owner financing contract is signed, it’s important to record it with the appropriate government office, typically the county recorder’s office. Recording the contract creates a public record of the transaction and protects the seller’s interest in the property.

To record an owner financing contract:

- Obtain the necessary documents: Ensure you have the signed contract and any required supporting documents.

- Determine the recording fees: Check with the county recorder’s office for the applicable fees.

- Submit the documents: File the documents with the county recorder’s office.

- Obtain a recorded copy: Receive a recorded copy of the contract, which serves as proof of the transaction.

The Role of Title Insurance

Title insurance plays a crucial role in owner financing transactions. A title insurance policy protects the seller’s interest in the property and ensures that the seller has a valid, enforceable lien on the property.

It’s advisable for the seller to require the buyer to purchase a title insurance policy as a condition of the sale. This policy will protect the buyer’s interest in the property and ensure that there are no undisclosed liens or encumbrances that could jeopardize their ownership.

Servicing the Loan

Once the owner financing contract is in place, the seller becomes the lender and is responsible for servicing the loan. This involves:

- Collecting payments from the buyer

- Keeping accurate records of payments received

- Providing the buyer with an annual statement of account

- Reporting the interest paid by the buyer to the IRS (Form 1098)

Some sellers choose to use a third-party loan servicing company to handle these tasks, particularly if they have multiple owner-financed properties. These companies can help ensure compliance with legal requirements and provide a buffer between the seller and the buyer.

Books and Resources for Further Reading

For those looking to delve deeper into the world of owner financing contracts, here are some recommended books and resources:

- “The Paper Source Book for Owner Financing” by Jack Reed – This comprehensive guide covers everything from structuring deals to servicing loans.

- “Owner Financing on Steroids” by Wendy Patton – This book focuses on creative strategies for using owner financing to build wealth through real estate.

- “The Encyclopedia of Private Mortgage Investing” by Teri Clark – While not specific to owner financing, this book provides valuable insights into the world of private lending.

- BiggerPockets.com – This online community of real estate investors has a wealth of information on owner financing, including forums, blog posts, and podcasts.

By understanding the intricacies of owner financing contracts and working with experienced professionals, buyers and sellers can create win-win transactions that benefit both parties. While owner financing may not be the right choice for every situation, it can be a powerful tool for those looking to buy or sell property on their own terms.

Ready to Explore Owner Financing?

Owner financing offers a unique path to homeownership for buyers who may not qualify for traditional mortgages, while providing sellers with a steady stream of income and potentially a faster sale. By understanding the process, benefits, and risks involved, both parties can make informed decisions and create a mutually beneficial agreement.

Is Owner Financing Right for You?

Consider your financial situation, long-term goals, and risk tolerance when deciding whether owner financing is the best choice for your property transaction. If you’re a buyer, evaluate your ability to make consistent payments and understand the terms of the agreement. As a seller, assess the potential risks and rewards of acting as the lender.

Before entering into an owner financing agreement, consult with a real estate attorney and financial advisor to ensure you’re making a sound decision. With the right preparation and due diligence, owner financing can be a powerful tool for buyers and sellers alike.

What steps will you take to determine if owner financing is the right path for your real estate journey?

Discover Your Next Lever For Growth.

Every week, get an insider analysis of the largest eCom/Retail brands’ financials + a 3-Step Turnaround Plan for each biz. Your next growth opportunity is just an email away.

Join 4,210+ readers from Quip, Dr. Squatch, Jamby’s, Volcom and more.