Worried about outliving your retirement savings? You’re asking yourself: “How long will my money last?” You’re not alone. But don’t let uncertainty keep you up at night.

I’m going to share with you an easy-to-use retirement calculator that can show you how long your money will last in just 2 minutes. No complex math or confusing jargon. Just straightforward answers to help you plan with confidence.

Enter a few simple details – your age, retirement date, and savings – and get an instant personalized projection. See exactly how far your nest egg will take you.

Don’t leave your golden years to chance. Take control of your financial future today.

Let’s dive in and discover how to make your retirement savings last a lifetime.

How Long Will My Money Last? Calculate Your Retirement Savings with Our Easy-to-Use Retirement Calculator

Preparing for retirement can be overwhelming, especially when trying to figure out how much money you’ll need to maintain your desired lifestyle. That’s where our retirement calculator comes in handy. In just a few simple steps, you can get a personalized projection of your retirement income and determine how long your savings will last.

Here’s what our retirement calculator can do for you:

- Quickly estimate how long your retirement savings will last

- Input your current age, retirement age, and savings amount

- Get a personalized projection of your retirement income

With this information at your fingertips, you can make informed decisions about your retirement planning and adjust your savings strategy if needed. Our calculator takes the guesswork out of retirement planning, giving you peace of mind and helping you stay on track towards your financial goals.

To use the retirement calculator, simply follow these three steps:

- Enter your current age and planned retirement age

- Input your current retirement savings balance

- View your personalized retirement income projection

It’s that easy. In the next section, we’ll walk you through the first step of entering your current age and planned retirement age.

Step 1: Enter Your Current Age and Planned Retirement Age

- The retirement calculator uses your current age and planned retirement age to determine how long your retirement savings need to last

- Be realistic about your planned retirement age based on your financial situation and personal goals

To get started with the retirement calculator, the first step is to input your current age and the age at which you plan to retire. These two pieces of information are crucial for accurately estimating how long your retirement savings will need to last.

Why Your Current Age Matters

Your current age is an essential factor in retirement planning because it determines how much time you have left to save and invest for retirement. The earlier you start saving, the more time your money has to grow through compound interest.

For example, if you’re 30 years old and plan to retire at 65, you have 35 years to save and invest. However, if you’re 50 years old with the same retirement age goal, you only have 15 years to build your nest egg. This shorter timeline means you’ll need to save more each year to reach your retirement savings target.

Choosing a Realistic Planned Retirement Age

When deciding on your planned retirement age, it’s important to be realistic about your financial situation and personal goals. While many people aim to retire at age 65, this may not be feasible for everyone. Consider factors such as:

Your current savings rate

If you’re not saving enough each year, you may need to work longer to build a sufficient retirement fund. Use the retirement calculator to determine if your current savings rate aligns with your retirement goals.

Your desired retirement lifestyle

Do you envision a modest retirement lifestyle or one filled with travel and leisure activities? Your retirement lifestyle will impact how much money you’ll need to save.

Your health and life expectancy

If you have a family history of longevity or are in excellent health, you may need to plan for a longer retirement. On the other hand, if you have health concerns, you may want to consider retiring earlier to enjoy your retirement years.

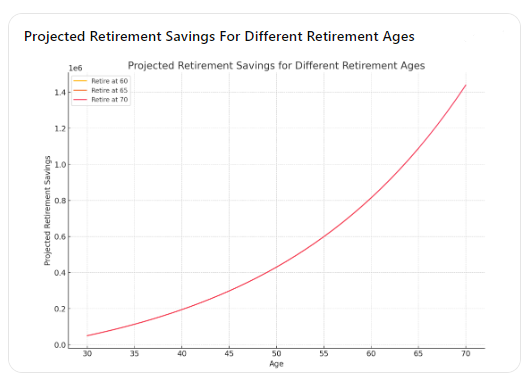

Projected Retirement Savings for Different Retirement Ages

The graph provided visualizes the projected retirement savings growth from the current age of 30 until the respective retirement ages of 60, 65, and 70. Each line represents the growth trajectory of savings given a consistent annual savings rate and investment return.

Using this information, you can adjust your savings rate or retirement age to meet your financial goals and ensure a comfortable retirement.

Retirement Savings Projections

| Age | Savings_until_age_60 | Savings_until_age_65 | Savings_until_age_70 |

|---|---|---|---|

| 30 | 50,000 | 50,000 | 50,000 |

| 31 | 61,500 | 61,500 | 61,500 |

| 32 | 73,575 | 73,575 | 73,575 |

| 33 | 86,254 | 86,254 | 86,254 |

| 34 | 99,566 | 99,566 | 99,566 |

| 35 | 113,545 | 113,545 | 113,545 |

| 36 | 128,222 | 128,222 | 128,222 |

| 37 | 143,633 | 143,633 | 143,633 |

| 38 | 159,815 | 159,815 | 159,815 |

| 39 | 176,805 | 176,805 | 176,805 |

| 40 | 194,646 | 194,646 | 194,646 |

| 41 | 213,378 | 213,378 | 213,378 |

| 42 | 233,047 | 233,047 | 233,047 |

| 43 | 253,699 | 253,699 | 253,699 |

| 44 | 275,384 | 275,384 | 275,384 |

| 45 | 298,153 | 298,153 | 298,153 |

| 46 | 322,061 | 322,061 | 322,061 |

| 47 | 347,164 | 347,164 | 347,164 |

| 48 | 373,522 | 373,522 | 373,522 |

| 49 | 401,199 | 401,199 | 401,199 |

| 50 | 430,258 | 430,258 | 430,258 |

| 51 | 460,771 | 460,771 | 460,771 |

| 52 | 492,810 | 492,810 | 492,810 |

| 53 | 526,450 | 526,450 | 526,450 |

| 54 | 561,773 | 561,773 | 561,773 |

| 55 | 598,862 | 598,862 | 598,862 |

| 56 | 637,805 | 637,805 | 637,805 |

| 57 | 678,695 | 678,695 | 678,695 |

| 58 | 721,630 | 721,630 | 721,630 |

| 59 | 766,711 | 766,711 | 766,711 |

| 60 | 814,047 | 814,047 | 814,047 |

| 61 | – | 863,749 | 863,749 |

| 62 | – | 915,937 | 915,937 |

| 63 | – | 970,733 | 970,733 |

| 64 | – | 1,028,270 | 1,028,270 |

| 65 | – | 1,088,684 | 1,088,684 |

| 66 | – | – | 1,152,118 |

| 67 | – | – | 1,218,724 |

| 68 | – | – | 1,288,660 |

| 69 | – | – | 1,362,093 |

| 70 | – | – | 1,439,197 |

Once you’ve entered your current age and planned retirement age into the calculator, you’re ready to move on to the next step: inputting your current retirement savings balance. This will give the calculator a starting point for projecting your retirement savings growth over time.

Step 2: Input Your Current Retirement Savings Balance

- Gather all your retirement account statements to get an accurate total

- Include 401(k)s, IRAs, pensions, and any other investments for retirement

- This step is crucial for calculating how long your money will last

Collecting Your Retirement Account Information

To accurately determine your current retirement savings balance, you’ll need to gather statements from all your retirement accounts. This includes employer-sponsored plans like 401(k)s, individual retirement accounts (IRAs), and pension plans if you have them.

If you have multiple accounts, it’s essential to include all of them to get a comprehensive picture of your retirement savings. Don’t forget to factor in any additional savings or investments you’ve earmarked for retirement, such as brokerage accounts or savings bonds.

Types of Retirement Accounts to Include

401(k) Plans

401(k) plans are employer-sponsored retirement accounts that allow you to save a portion of your paycheck on a pre-tax basis. Many employers offer matching contributions, which can significantly boost your savings. Be sure to include the balance from your current 401(k) and any 401(k)s from previous employers. According to NerdWallet, it’s recommended to save 10% to 15% of your pretax income for retirement.

- If you’re unsure about your 401(k) balance or how to access your account, contact your human resources department or the plan administrator for assistance.

Individual Retirement Accounts (IRAs)

IRAs are personal retirement accounts that you open and manage independently from your employer. There are two main types of IRAs: Traditional and Roth.

- Traditional IRA contributions may be tax-deductible, and the earnings grow tax-deferred until withdrawal.

- Roth IRA contributions are made with after-tax dollars, but the earnings grow tax-free.

According to SmartAsset, a common guideline is to replace 70% of your annual income before retirement.

Include the balances from all your IRA accounts when calculating your total retirement savings.

Pension Plans

If you’re fortunate enough to have a pension plan through your employer, be sure to include the estimated value of your future pension benefits in your retirement savings calculation. Contact your pension plan administrator to get an estimate of your expected monthly benefit at retirement age.

Totaling Your Retirement Savings Balance

Once you’ve gathered all your retirement account information, it’s time to add up the balances to determine your current retirement savings total. This number is a critical input for calculating how long your money will last in retirement.

If you have a spouse or partner, be sure to include their retirement savings as well, as you’ll likely be pooling your resources in retirement.

- Double-check your total to ensure you haven’t overlooked any accounts or made any calculation errors.

Step 3: Estimate Your Annual Retirement Expenses

- Calculate your current yearly expenses and project them into retirement

- Factor in lifestyle changes, healthcare costs, and inflation

- Create a realistic budget to ensure your savings last throughout retirement

Assessing Your Current Expenses

To estimate your annual retirement expenses, start by analyzing your current spending habits. Review your bank statements, credit card bills, and receipts from the past year to get a clear picture of your monthly costs. Categorize your expenses into essential (housing, food, utilities) and non-essential (entertainment, travel) items.

Creating an Expense Spreadsheet

Create a spreadsheet to track your expenses more efficiently. List all your expense categories and their corresponding monthly amounts. This will help you identify areas where you might be overspending and make adjustments accordingly.

Projecting Expenses into Retirement

Once you have a solid understanding of your current expenses, it’s time to project them into retirement. Consider how your lifestyle might change during retirement. Will you travel more? Pursue new hobbies? Downsize your home?

Accounting for Lifestyle Changes

Think about the activities you plan to enjoy in retirement and estimate their associated costs. For example, if you plan to travel more, research the average cost of flights, accommodations, and activities for your desired destinations. Include these expenses in your retirement budget.

Factoring in Healthcare Costs and Inflation

As you age, your healthcare costs are likely to increase. Research the average healthcare expenses for retirees in your area and include them in your budget. Don’t forget to account for potential long-term care costs, such as assisted living or nursing home fees.

Inflation is another critical factor to consider when estimating your retirement expenses. Over time, the purchasing power of your money will decrease due to rising prices. Use an inflation calculator, such as the one provided by the Bureau of Labor Statistics, to adjust your projected expenses for the years leading up to and during retirement.

Creating a Realistic Retirement Budget

With your projected expenses in hand, create a realistic retirement budget. Allocate your estimated income sources (Social Security, pensions, investments) to cover your essential expenses first, then distribute the remainder among your non-essential costs.

Stress-Testing Your Budget

To ensure your retirement savings last, stress-test your budget by considering various scenarios, such as market downturns, unexpected expenses, or longer life expectancy. Adjust your budget accordingly to maintain a comfortable lifestyle throughout retirement.

By thoroughly assessing your current expenses, projecting them into retirement, and creating a realistic budget, you’ll have a clearer picture of your annual retirement expenses. This information will be crucial for determining if your current savings will be sufficient to support your desired retirement lifestyle.

Potential Unexpected Expenses and How to Plan for Them

When planning for retirement, it’s essential to consider potential unexpected expenses that could impact your financial stability. Here are some common unexpected expenses and strategies to plan for them:

1. Healthcare Costs

- Unexpected Expenses: Medical emergencies, surgeries, long-term care, prescription medications, dental and vision care.

- Planning Strategies:

- Health Insurance: Ensure you have comprehensive health insurance that covers a wide range of medical expenses.

- Health Savings Account (HSA): Contribute to an HSA if you’re eligible. HSAs offer tax advantages and can be used to cover qualified medical expenses.

- Medicare Planning: Understand what Medicare covers and consider additional supplemental insurance for services not covered by Medicare.

2. Home Repairs and Maintenance

- Unexpected Expenses: Roof repairs, plumbing issues, appliance replacements, home modifications for aging in place.

- Planning Strategies:

- Emergency Fund: Set aside an emergency fund specifically for home repairs and maintenance.

- Home Warranty: Consider purchasing a home warranty to cover major home systems and appliances.

- Regular Maintenance: Conduct regular maintenance to prevent major repairs.

3. Family Support

- Unexpected Expenses: Financial assistance to children or grandchildren, caregiving costs for aging parents.

- Planning Strategies:

- Open Communication: Discuss financial expectations with family members to set clear boundaries.

- Budget for Support: Include potential family support in your retirement budget.

- Life Insurance: Consider life insurance to provide for dependents if necessary.

4. Market Volatility

- Unexpected Expenses: Decline in investment portfolio value due to market downturns.

- Planning Strategies:

- Diversified Portfolio: Maintain a diversified investment portfolio to reduce risk.

- Withdrawal Strategy: Develop a flexible withdrawal strategy that allows you to adjust withdrawals based on market conditions.

- Cash Reserve: Keep a cash reserve to avoid selling investments at a loss during market downturns.

5. Legal Issues

- Unexpected Expenses: Legal fees for disputes, estate planning, or other legal matters.

- Planning Strategies:

- Legal Insurance: Consider legal insurance to cover potential legal fees.

- Estate Planning: Ensure your estate plan is up to date to minimize potential legal issues.

- Emergency Fund: Allocate a portion of your emergency fund for legal expenses.

6. Inflation

- Unexpected Expenses: Higher than expected cost of living due to rising prices.

- Planning Strategies:

- Inflation-Protected Investments: Invest in assets that offer protection against inflation, such as Treasury Inflation-Protected Securities (TIPS).

- Regular Budget Review: Regularly review and adjust your budget to account for inflation.

- Cost-of-Living Adjustments: Factor in cost-of-living adjustments (COLAs) for pensions and Social Security.

7. Natural Disasters

- Unexpected Expenses: Damage to property, temporary relocation costs, insurance deductibles.

- Planning Strategies:

- Homeowners Insurance: Ensure your homeowners insurance policy covers natural disasters common in your area.

- Emergency Fund: Have an emergency fund that includes provisions for natural disaster expenses.

- Disaster Plan: Develop a disaster plan to quickly respond to emergencies.

Creating a Contingency Plan

To manage these unexpected expenses, create a contingency plan that includes:

- Emergency Fund: Aim to save 3-6 months’ worth of living expenses in a readily accessible account.

- Insurance: Regularly review and update your insurance policies to ensure adequate coverage.

- Flexible Budget: Design a budget that can be adjusted in response to unexpected expenses.

- Professional Advice: Consult with a financial advisor to develop strategies tailored to your specific needs and circumstances.

By anticipating potential unexpected expenses and incorporating these planning strategies, you can help ensure that your retirement savings are sufficient to maintain your desired lifestyle even in the face of unforeseen challenges.

Step 4: Review Your Personalized Retirement Income Projection

- The retirement calculator provides an estimated monthly income based on your inputs

- Use this information to adjust your retirement savings goals and strategies

- Understand how your current savings and future contributions impact your retirement lifestyle

Understanding Your Personalized Retirement Income Projection

After entering your current age, retirement age, life expectancy, annual income, current retirement savings, and estimated annual retirement expenses, the retirement calculator generates a personalized retirement income projection. This projection estimates the monthly income you can expect to receive during retirement based on your inputs.

The personalized retirement income projection takes into account factors such as your current savings, future contributions, investment returns, and inflation to provide a realistic estimate of your retirement income. It’s important to review this projection carefully to understand how your current financial situation and future plans impact your retirement lifestyle.

Interpreting Your Retirement Income Projection

When reviewing your personalized retirement income projection, pay attention to the estimated monthly income figure. This number represents the amount of money you can expect to have available each month during retirement, based on your current savings, future contributions, and estimated expenses.

Compare this monthly income figure to your estimated monthly retirement expenses to determine whether your projected retirement income will be sufficient to cover your anticipated costs. If your projected income falls short of your estimated expenses, you may need to consider adjusting your retirement savings goals or strategies.

Assessing the Gap Between Your Projected Income and Expenses

If your personalized retirement income projection reveals a gap between your estimated monthly income and expenses, don’t panic. This is an opportunity to make informed decisions about your retirement savings plan.

Consider the following options to bridge the gap:

- Increase your current retirement savings contributions

- Adjust your investment strategy to potentially earn higher returns

- Reevaluate your estimated retirement expenses to identify areas where you can reduce costs

- Consider delaying your retirement age to give yourself more time to save and benefit from compound interest

Using Your Retirement Income Projection to Make Informed Decisions

Your personalized retirement income projection is a valuable tool for making informed decisions about your retirement savings plan. By understanding how your current savings, future contributions, and estimated expenses impact your retirement lifestyle, you can take proactive steps to ensure a comfortable and financially secure retirement.

Use your retirement income projection to:

- Set realistic retirement savings goals based on your desired retirement lifestyle

- Adjust your current savings contributions to align with your goals

- Evaluate your investment strategy and make changes as needed to maximize returns

- Regularly review and update your retirement plan as your financial situation and goals evolve

By thoroughly reviewing your personalized retirement income projection and using it to guide your retirement savings decisions, you can take control of your financial future and work towards achieving the retirement lifestyle you desire.

Maximize Your Retirement Funds with These Proven Income Strategies

- Diversify your retirement income sources to minimize risk and ensure a steady cash flow

- Optimize your portfolio with a mix of traditional and Roth retirement accounts for tax efficiency

- Explore annuities and other guaranteed income options to safeguard your financial future

Diversify Your Retirement Income Sources

Diversifying your retirement income sources is a crucial strategy for minimizing risk and ensuring a stable cash flow throughout your golden years. By spreading your investments across various asset classes and income streams, you can better weather market fluctuations and economic uncertainties.

Consider investing in a mix of stocks, bonds, real estate, and other alternative investments to create a well-balanced portfolio. Each asset class has its own risk-return profile, and by diversifying, you can optimize your portfolio’s performance while reducing overall volatility.

Historical data shows that stocks have returned around 10% on average over the long term, while bonds have returned around 5%. Real estate investments, such as REITs, have also provided consistent returns over time.

In addition to traditional investment vehicles, explore alternative income sources such as rental properties, peer-to-peer lending, or even starting a small business. These options can provide a steady stream of income that is less dependent on market conditions.

Optimize Your Portfolio with Traditional and Roth Accounts

Maximizing your retirement savings involves more than just contributing to a 401(k) or IRA. It’s essential to understand the tax implications of different account types and how they can impact your retirement income.

Traditional retirement accounts, such as 401(k)s and Traditional IRAs, allow you to make pre-tax contributions, reducing your current taxable income. However, withdrawals in retirement are taxed as ordinary income. On the other hand, Roth accounts, like Roth 401(k)s and Roth IRAs, are funded with after-tax dollars but offer tax-free growth and withdrawals in retirement.

Tax Diversification Strategy

Implementing a tax diversification strategy by investing in both traditional and Roth accounts can provide flexibility and optimize your tax liability in retirement. By having a mix of accounts, you can strategically withdraw funds from each account type based on your tax bracket and income needs, potentially lowering your overall tax burden.

| Account Type | Contribution | Taxation | Withdrawal |

|---|---|---|---|

| Traditional | Pre-tax | Taxed as ordinary income | Taxed as ordinary income |

| Roth | After-tax | Tax-free | Tax-free |

Explore Annuities and Guaranteed Income Options

As life expectancy continues to rise, ensuring a reliable income stream throughout retirement becomes increasingly important. Annuities and other guaranteed income options can provide a safety net, helping to mitigate the risk of outliving your savings.

Annuities are insurance products that convert a lump sum payment into a guaranteed income stream for a specified period or lifetime. There are various types of annuities, such as fixed, variable, and indexed, each with its own features and benefits. Fixed annuities offer a guaranteed interest rate and fixed payments, while variable annuities allow you to invest in a range of subaccounts with the potential for higher returns but also greater risk.

Longevity Annuities

Longevity annuities, also known as deferred income annuities, are designed to provide a guaranteed income stream later in life, typically starting around age 80 or 85. By purchasing a longevity annuity with a portion of your retirement savings, you can ensure a reliable income source in your later years, reducing the risk of exhausting your funds.

Income annuities can provide a hedge against outliving your savings, with lifetime income annuities guaranteeing payments even if your account balance reaches zero. Additionally, annuities can offer tax-deferred growth, meaning you pay ordinary income taxes only when you receive payments.

When considering annuities or other guaranteed income options, it’s essential to carefully evaluate the costs, fees, and potential drawbacks. Consult with a financial professional to determine if these products align with your retirement goals and overall financial plan.

Diversify Your Retirement Portfolio

- Reduce risk by investing in a variety of assets like stocks, bonds, and real estate

- Keep your portfolio balanced by regularly adjusting your asset mix

Diversifying your retirement portfolio is a key strategy for managing risk and ensuring long-term financial stability. By spreading your investments across different asset classes, you can minimize the impact of market volatility on your overall portfolio.

As financial expert and author of “The Intelligent Investor” Benjamin Graham, famously said,

“Diversification is an established tenet of conservative investment.”

– Benjamin Graham

This advice holds true for retirement planning, where preserving your wealth is just as important as growing it.

Invest in a Mix of Stocks, Bonds, and Real Estate

A well-diversified retirement portfolio typically includes a mix of stocks, bonds, and real estate. Each of these asset classes has its own risk and return characteristics, and combining them can help smooth out the ups and downs of the market.

Stocks for Growth Potential

Stocks represent ownership in a company and offer the potential for long-term growth. While they can be more volatile than other investments, stocks have historically outperformed bonds and cash over extended periods. The average stock market return is approximately 10% per year, as measured by the S&P 500 index, but this return is reduced by inflation. For example, the S&P 500’s average annualized return between 2003 and 2023 was 10.20%.

Bonds for Stability and Income

Bonds are essentially loans made to corporations or governments. They provide a predictable stream of income through regular interest payments and can help balance the volatility of stocks in your portfolio.

As you near retirement, increasing your allocation to bonds can help protect your portfolio from market downturns.

“A good rule of thumb is to keep at least 10 years’ worth of expenses in bonds.”

– Kiplinger’s Personal Finance

Real Estate for Diversification and Potential Income

Real estate, whether through direct ownership of properties or real estate investment trusts (REITs), can provide diversification benefits and a source of income in retirement. Jeff Brown, a real estate investing expert and host of the “BawldGuy Mentoring Podcast” notes:

“Real estate is a great portfolio diversifier that’s not directly correlated with the stock market.”

Regularly Rebalance Your Portfolio

Over time, the performance of different assets in your portfolio will cause your asset allocation to drift from its original target. Regularly rebalancing your portfolio helps maintain your desired level of risk and return.

Financial planner Michael Kitces recommends rebalancing:

“Whenever an asset class is off by 20% from its target”

So, if your target allocation for stocks is 60% and your actual allocation drifts to 72% (a 20% increase), it’s time to rebalance.

Rebalancing involves selling assets that have become overweighted and using the proceeds to buy assets that are underweighted. This disciplined approach helps you stick to your long-term investment strategy and avoid making emotion-driven decisions based on short-term market movements.

“Rebalancing is crucial to maintaining a consistent risk profile and ensuring that your portfolio remains aligned with your investment objectives”

– Schwab expert

By diversifying your retirement portfolio and regularly rebalancing your assets, you can help ensure that your money lasts throughout your retirement years. In the next section, we’ll explore strategies for creating a sustainable withdrawal plan to support your desired retirement lifestyle.

Create a Sustainable Withdrawal Strategy

- Determine a safe withdrawal rate based on your retirement timeline and risk tolerance

- Adjust your withdrawals as needed to account for market fluctuations and inflation

Creating a sustainable withdrawal strategy is crucial for ensuring your retirement savings last as long as you need them to. According to a study by the Employee Benefit Research Institute,

“A 65-year-old man would need $72,000 in savings and a 65-year-old woman would need $104,000 if each wanted a 90% chance of having enough money to cover health care expenses in retirement.”

Determine a Safe Withdrawal Rate

Your withdrawal rate is the percentage of your retirement savings you withdraw each year to cover living expenses. The widely accepted “4% rule” suggests that withdrawing 4% of your retirement savings annually, adjusted for inflation, should allow your money to last 30 years.

This rule may not work for everyone. As Certified Financial Planner Michael Kitces notes,

“The safe withdrawal rate is highly dependent on the retiree’s time horizon. For those with a shorter retirement time horizon, the safe withdrawal rate can be higher.”

Factors That Affect Your Safe Withdrawal Rate

Your safe withdrawal rate depends on several factors, including:

- Your retirement timeline: The longer your retirement, the lower your withdrawal rate should be.

- Your risk tolerance: If you’re comfortable with more risk, you may be able to withdraw more each year.

- Market conditions: In years when the market performs well, you may be able to withdraw more, while in down years, you may need to withdraw less.

Adjust Withdrawals for Market Fluctuations and Inflation

Inflation and market volatility can significantly impact your retirement savings. To account for these factors, consider adjusting your withdrawals annually.

As David Blanchett, head of retirement research at Morningstar Investment Management, suggests,

“You should be updating your withdrawal rate every year based on the performance of your portfolio and changes in your spending.”

Strategies for Adjusting Withdrawals

Some strategies for adjusting your withdrawals include:

- Using a dynamic withdrawal strategy: This involves adjusting your withdrawal rate based on market performance. In good years, you withdraw more, and in bad years, you withdraw less.

- Implementing a floor-and-ceiling approach: This strategy involves setting a “floor” (the minimum amount you need to withdraw each year) and a “ceiling” (the maximum amount you’ll withdraw). If your portfolio performs well, you can withdraw up to the ceiling amount, but if it performs poorly, you’ll only withdraw the floor amount.

By determining a safe withdrawal rate and adjusting your withdrawals as needed, you can create a sustainable retirement income stream that lasts as long as you need it to. Keep in mind that your withdrawal strategy should be tailored to your unique financial situation and goals, so it’s essential to review and update it regularly.

Key Factors That Impact How Long Your 401(k) and Other Retirement Savings Will Last

- Your retirement age, life expectancy, and spending habits directly affect how long your savings will last

- Inflation and market volatility can significantly impact the longevity of your retirement funds

- Understanding these factors can help you create a sustainable withdrawal strategy

Your Retirement Age and Life Expectancy

The age at which you choose to retire plays a crucial role in determining how long your retirement savings will last. The earlier you retire, the longer your savings will need to stretch to support your lifestyle. For example, if you retire at 60 instead of 65, your savings will need to cover an additional five years of expenses.

When estimating your life expectancy, consider factors such as your current health, family medical history, and lifestyle habits. According to the Social Security Administration, a 65-year-old man can expect to live until age 84.2, while a 65-year-old woman can expect to live until age 86.7. However, it’s essential to plan for the possibility of living longer than the average life expectancy to ensure your savings last throughout your retirement years.

Inflation and Market Volatility

Inflation can significantly erode the purchasing power of your retirement savings over time. As the cost of goods and services rises, your fixed income from retirement accounts may not stretch as far as it once did. To account for inflation, consider incorporating investments that have the potential to outpace inflation, such as stocks or real estate investment trusts (REITs).

Market volatility can also impact the longevity of your retirement funds. A significant market downturn in the early years of your retirement can deplete your savings more quickly than anticipated. To mitigate this risk, consider maintaining a diversified portfolio that includes a mix of stocks, bonds, and cash reserves. Additionally, be prepared to adjust your withdrawal rate during market downturns to avoid depleting your savings too quickly.

Your Retirement Lifestyle and Expenses

Your spending habits in retirement will directly affect how long your savings last. Be realistic about your anticipated expenses, including housing, healthcare, travel, and leisure activities. If you plan to maintain a more luxurious lifestyle in retirement, your savings will need to be sufficient to support those expenses over the long term.

Creating a Retirement Budget

To ensure your retirement savings last as long as possible, create a comprehensive retirement budget that accounts for all of your anticipated expenses. Start by tracking your current spending habits and identifying areas where you may be able to reduce costs in retirement, such as downsizing your home or eliminating work-related expenses.

When creating your budget, don’t forget to account for healthcare costs, which can be a significant expense in retirement. According to the Fidelity Retiree Health Care Cost Estimate, a 65-year-old couple retiring in 2023 can expect to spend an average of $315,000 on healthcare expenses throughout their retirement years.

Adjusting Your Retirement Lifestyle

If your retirement savings are not sufficient to support your desired lifestyle, consider making adjustments to your spending habits. This may involve downsizing your home, traveling less frequently, or finding more affordable leisure activities. By being proactive and making these adjustments early in retirement, you can help ensure that your savings last longer.

How Long Will $300,000 Last in a 401(k)?

The length of time that $300,000 will last in a 401(k) depends on several factors, including your withdrawal rate, investment returns, and inflation. Assuming a 4% annual withdrawal rate and a 5% annual return on investments, $300,000 could last approximately 25 years in retirement. However, this estimate does not account for inflation or any significant market downturns.

To make your $300,000 last longer, consider implementing a more conservative withdrawal strategy, such as the 3% rule. This approach involves withdrawing 3% of your initial retirement savings each year, adjusted for inflation. By reducing your withdrawal rate, you can help ensure that your savings last throughout your retirement years, even if you experience lower investment returns or higher inflation.

Can My 401(k) Lose Money After I Retire?

Yes, your 401(k) can lose money after you retire, particularly if you maintain a significant portion of your savings in investments that are subject to market volatility, such as stocks. While stocks have the potential to provide higher returns over the long term, they also carry a higher level of risk than more conservative investments, such as bonds.

To mitigate the risk of losing money in your 401(k) after retirement, consider adjusting your asset allocation to include a greater proportion of conservative investments, such as bonds or cash reserves. This approach can help reduce the impact of market downturns on your retirement savings, while still providing some potential for growth.

Real-World Examples: How Long Will $500,000, $1 Million, and $3 Million Last in Retirement?

- Discover how long your retirement savings may last based on different portfolio sizes

- Learn about the 4% rule and how it applies to real-world retirement scenarios

- Understand the impact of factors like inflation and market performance on retirement income

$500,000 Retirement Savings

Retiring with $500,000 in savings is a significant milestone, but how long will it actually last? Assuming a 4% annual withdrawal rate, a $500,000 portfolio could provide approximately $20,000 per year in retirement income. This withdrawal rate is based on the well-known “4% rule,” which suggests that retirees can safely withdraw 4% of their initial portfolio balance each year, adjusted for inflation, without running out of money over a 30-year retirement.

Factors Affecting the Longevity of a $500,000 Retirement Portfolio

The longevity of a $500,000 retirement portfolio depends on several factors, including:

- Inflation: As the cost of goods and services rises over time, the purchasing power of your retirement income may decrease. If inflation averages 3% per year, your $20,000 annual withdrawal will have the buying power of just $13,765 after 15 years.

- Market performance: The success of your retirement plan heavily relies on the performance of your investments. If your portfolio experiences lower returns than expected, your savings may not last as long as projected.

Considering these factors, a $500,000 retirement portfolio may last around 25-30 years, depending on your individual circumstances. However, this estimate assumes no additional sources of income, such as Social Security benefits or a pension.

$1 Million Retirement Savings

A $1 million retirement portfolio is often considered a significant goal for many investors. Using the same 4% withdrawal rate, a $1 million portfolio could generate approximately $40,000 per year in retirement income. This annual income is roughly double that of a $500,000 portfolio, providing a more comfortable retirement lifestyle.

The Impact of Lifestyle on a $1 Million Retirement Portfolio

The longevity of a $1 million retirement portfolio depends not only on economic factors but also on your lifestyle and spending habits. If you maintain a modest lifestyle and keep your expenses in check, your $1 million nest egg could sustain you for approximately 30-35 years. However, if you have more expensive tastes or unexpected medical costs, your savings may not stretch as far.

| Annual Withdrawal Rate | Years $1 Million Will Last |

|---|---|

| 3% | 40-45 years |

| 4% | 30-35 years |

| 5% | 25-30 years |

$3 Million Retirement Savings

For those who have managed to save $3 million for retirement, the 4% withdrawal rate would provide a substantial annual income of $120,000. This level of retirement savings offers greater financial security and flexibility, allowing for a more comfortable and potentially longer retirement.

The Benefits of a $3 Million Retirement Portfolio

With $3 million in retirement savings, you may enjoy several benefits:

- Higher annual income: The 4% withdrawal rate provides a significant annual income of $120,000, which can support a more luxurious lifestyle or allow for more travel and leisure activities.

- Longer retirement horizon: A larger retirement portfolio has a better chance of lasting throughout a longer retirement. Assuming a 4% withdrawal rate, a $3 million portfolio could last 35-40 years or more, depending on market conditions and lifestyle factors.

- Greater flexibility: With a larger retirement portfolio, you have more flexibility to adjust your withdrawal rate based on market performance or personal circumstances. For example, if your investments perform well, you may choose to increase your annual withdrawal slightly to enjoy a higher standard of living.

It’s important to note that while these examples provide a general idea of how long different retirement portfolio sizes may last, individual results will vary based on factors such as retirement age, life expectancy, investment strategy, and personal circumstances. Consulting with a financial advisor can help you develop a personalized retirement plan tailored to your unique goals and needs.

Understanding Retirement Savings: Types of Accounts and Their Benefits

- Different retirement accounts offer unique tax advantages and benefits

- Choosing the right mix of accounts can help maximize your retirement savings

- Pension plans and Social Security benefits can provide additional income in retirement

Traditional 401(k) and IRA Plans

Traditional 401(k) and IRA plans are popular retirement savings options that allow you to contribute pre-tax dollars, reducing your current taxable income. Contributions to these accounts grow tax-deferred, meaning you won’t pay taxes on the money until you withdraw it in retirement. At that point, withdrawals are taxed as ordinary income.

One of the main benefits of traditional 401(k) and IRA plans is the immediate tax savings they provide. By contributing pre-tax dollars, you can lower your current tax bill and potentially fall into a lower tax bracket. This can be especially beneficial if you expect to be in a lower tax bracket in retirement than you are currently.

Many employers offer matching contributions for 401(k) plans, which can significantly boost your retirement savings. For example, if your employer matches 50% of your contributions up to 6% of your salary, and you contribute 6% of your salary, you’re effectively receiving a 3% boost to your retirement savings each year.

Contribution Limits and Catch-Up Contributions

For 2024, the contribution limit for 401(k) plans is $22,500, with an additional $7,500 catch-up contribution allowed for those aged 50 and older. IRA contribution limits are $6,500, with a $1,000 catch-up contribution for those 50 and older.

Roth 401(k) and IRA Plans

Roth 401(k) and IRA plans differ from traditional plans in that contributions are made with after-tax dollars. While this means you don’t get an immediate tax break, qualified withdrawals in retirement are tax-free. This can provide significant tax savings if you expect to be in a higher tax bracket in retirement than you are currently.

Another benefit of Roth plans is that they offer tax diversification. By having both traditional and Roth accounts, you can strategically withdraw funds in retirement to minimize your tax liability. For example, you might withdraw from your traditional accounts up to a certain tax bracket, then switch to tax-free Roth withdrawals to avoid pushing yourself into a higher bracket.

It’s important to note that not all employers offer Roth 401(k) options, and income limits apply to Roth IRA contributions. In 2023, the income phase-out range for Roth IRA contributions is $138,000 to $153,000 for single filers and $218,000 to $228,000 for married couples filing jointly.

Pension Plans and Social Security Benefits

While pension plans and Social Security benefits are not savings accounts per se, they can provide valuable income in retirement.

Pension plans, also known as defined benefit plans, provide guaranteed income in retirement based on factors such as your salary and years of service with an employer. However, pension plans have become less common in recent years, with many employers shifting to defined contribution plans like 401(k)s.

Social Security benefits are based on your lifetime earnings and the age at which you begin claiming benefits. While Social Security can provide a foundation for retirement income, it’s important not to rely on it exclusively. As of 2023, the average monthly Social Security benefit is $1,837, which may not be enough to cover all of your retirement expenses.

To maximize your retirement income, it’s crucial to understand how pension plans and Social Security benefits work alongside your other retirement savings accounts. Consider factors such as your full retirement age, spousal benefits, and how your benefits may be taxed when developing your retirement income strategy.

Retirement Planning Basics: Start Saving Early and Consistently

- The earlier you start saving for retirement, the more time your money has to grow

- Consistent contributions, even small amounts, can make a significant impact over time

- Regularly reviewing your retirement plan and making adjustments is crucial for staying on track

The Power of Compound Interest

Compound interest is one of the most powerful tools in retirement planning. It occurs when the interest you earn on your investments begins to earn interest on itself, leading to exponential growth over time. The earlier you start saving, the more time your money has to benefit from compound interest.

Let’s consider an example. If you start saving $200 per month at age 25, assuming an annual return of 7%, you would have approximately $821,000 by age 65. However, if you wait until age 35 to start saving the same amount, you would only have around $380,000 by age 65. This substantial difference highlights the importance of starting early. You can use tools like the Compound Interest Calculator to see how compound interest can impact your savings.

Consistent Contributions Matter

While starting early is crucial, consistently contributing to your retirement savings is equally important. Even if you can only afford to save a small amount each month, making it a habit can have a significant impact over time.

Consider increasing your contributions whenever possible, such as when you receive a raise or bonus at work. Many employers offer a match on retirement contributions, which is essentially free money. Make sure to take full advantage of this benefit by contributing at least enough to receive the maximum match.

Regularly Reassess Your Retirement Goals and Progress

Your retirement plan is not a set-it-and-forget-it endeavor. It’s essential to review your plan annually and make adjustments as needed. As your life circumstances change, such as getting married, having children, or changing jobs, your retirement goals and strategies may need to be updated.

When reviewing your plan, consider factors such as your current savings rate, investment performance, and estimated retirement expenses. If you find that you’re not on track to meet your goals, look for ways to increase your contributions or adjust your investment strategy.

Seek Professional Financial Advice

While it’s possible to manage your retirement planning on your own, seeking the guidance of a professional financial advisor can be incredibly beneficial. An advisor can help you create a personalized retirement plan that takes into account your unique financial situation, risk tolerance, and long-term goals.

A financial advisor can provide valuable guidance on investment strategies, helping you create a diversified portfolio that balances risk and potential returns. They can also assist with tax planning, ensuring that you’re taking advantage of all available tax benefits and minimizing your tax liability in retirement.

As you near retirement, an advisor can help you optimize your retirement income by creating a strategic withdrawal plan. This may involve a combination of drawing from your various retirement accounts, Social Security benefits, and other income sources in a way that maximizes your income while minimizing taxes.

Some popular books on retirement planning that provide deeper insights include:

- “The Ultimate Retirement Guide for 50+” by Suze Orman

- “How to Make Your Money Last: The Indispensable Retirement Guide” by Jane Bryant Quinn

- “The New Rules of Retirement: Strategies for a Secure Future” by Robert C. Carlson

Take Control of Your Retirement Future

Estimating how long your retirement savings will last is a crucial step in securing your financial future. By using our simple retirement calculator and inputting your current age, planned retirement age, and savings balance, you can quickly get a personalized projection of your retirement income.

Don’t Leave Your Retirement to Chance

Factors like inflation, market volatility, and your retirement lifestyle can significantly impact the longevity of your savings. By diversifying your retirement portfolio, creating a sustainable withdrawal strategy, and regularly reassessing your goals, you can maximize your funds and ensure a comfortable retirement.

Whether you have $500,000, $1 million, or $3 million saved, understanding how long your money will last is the first step in creating a solid retirement plan. By starting early, saving consistently, and seeking professional advice when needed, you can take control of your retirement future and enjoy the peace of mind that comes with financial security.

What steps will you take today to ensure your retirement savings last as long as you need them to?

Discover Your Next Lever For Growth.

Every week, get an insider analysis of the largest eCom/Retail brands’ financials + a 3-Step Turnaround Plan for each biz. Your next growth opportunity is just an email away.

Join 4,210+ readers from Quip, Dr. Squatch, Jamby’s, Volcom and more.