In 2024, over $5 billion worth of online businesses will change hands, from small e-commerce stores to content empires generating millions in annual revenue.

But with so many platforms vying for your attention, how do you choose the right one?

That’s the question I found myself grappling with when I decided to sell my own online business earlier this year. I spent countless hours researching, comparing, and even testing out different platforms, all in the hopes of finding the perfect match.

And now, I want to share my findings with you.

In this ultimate showdown, we’ll pit the top online business-for-sale platforms against each other, evaluating their strengths, weaknesses, and unique offerings. We’ll explore the role of business brokers, decode valuation methods, and even discuss the profitability of online selling in 2024.

Whether you’re a seasoned entrepreneur looking to sell your digital asset or a first-time buyer eager to dive into the world of online business ownership, this comprehensive guide will arm you with the knowledge and insights you need to make informed decisions and achieve your goals.

So, let’s roll up our sleeves and dive into the exciting world of online business acquisitions.

Evaluating the Top Online Business-for-Sale Platforms: A Comprehensive Guide

When deciding to buy or sell an online business, choosing the right platform is crucial. In this section, we’ll dive into the key factors to consider and compare the leading platforms head-to-head.

Key factors to consider when choosing a platform

Before committing to a platform, it’s essential to evaluate several critical aspects:

Reputation and track record of the platform

Look for platforms with a proven history of successful transactions and positive user reviews. This ensures a reliable and trustworthy experience.

Types of businesses listed for sale

Consider the variety and quality of businesses available on each platform. Some specialize in specific niches, while others offer a wide range of opportunities.

User interface and ease of navigation

A user-friendly interface makes the process of searching, evaluating, and transacting more efficient. Look for platforms with intuitive navigation and robust search filters.

Customer support and resources available

Access to helpful resources and responsive customer support can make a significant difference in your experience. Check for guides, tutorials, and dedicated support teams.

Comparing the leading platforms head-to-head

To help you make an informed decision, let’s compare three of the top online business-for-sale platforms: Flippa, BizBuySell, and Empire Flippers.

| Feature | Flippa | BizBuySell | Empire Flippers |

|---|---|---|---|

| Established | 2009 | 1996 | 2011 |

| Listing fees | $49 – $499 | $0 – $999 | $0 |

| Success fees | 5% – 15% | 10% | 15% |

| Average selling price | $50,000 | $200,000 | $183,000 |

| Vetting process | Basic | Moderate | Extensive |

| Customer support | Email, chat | Phone, email | Phone, email, chat |

Unique features and benefits of each platform

- Flippa: Wide variety of listings, including websites, apps, and domains. Offers an auction-style bidding process.

- BizBuySell: Focuses on established businesses across various industries. Provides valuation tools and resources.

- Empire Flippers: Specializes in high-quality, profitable online businesses. Conducts thorough vetting and due diligence.

Case studies of successful transactions on each platform

- Flippa: In 2020, a content website sold for $1.6 million after receiving over 100 bids.

- BizBuySell: A software company with $5 million in annual revenue sold within 6 months of listing.

- Empire Flippers: An Amazon FBA business with $3 million in annual net profit sold for $7.5 million.

After evaluating the key factors and comparing the platforms, Empire Flippers emerges as the winner for its extensive vetting process, high-quality listings, and dedicated customer support. However, the best platform for you will depend on your specific needs and preferences.

Leveraging Business Brokers for a Seamless Sale Process

- Business brokers offer expertise in valuation, pricing, and negotiations

- They have access to a network of qualified buyers and can handle paperwork

- Choosing the right broker involves evaluating their experience, fee structure, and client reviews

The role of business brokers in online business sales

Business brokers play a crucial role in facilitating the sale of online businesses. With their expertise in valuation and pricing strategies, they help sellers determine the true worth of their business and set a competitive asking price. Brokers have a deep understanding of market trends and can provide insights into factors that may impact the value of an online business, such as revenue streams, traffic sources, and growth potential.

Moreover, business brokers have access to a vast network of qualified buyers. They can leverage their connections to match sellers with serious, financially capable buyers who are genuinely interested in acquiring an online business. This targeted approach saves sellers time and effort, as they don’t have to sift through countless inquiries from unqualified or tire-kicking buyers.

Handling negotiations and paperwork

One of the most significant advantages of working with a business broker is their ability to handle negotiations and paperwork on behalf of the seller. Brokers are skilled negotiators who can navigate complex deal structures and ensure that the seller’s interests are protected throughout the process. They can also manage the due diligence process, gathering and organizing relevant documentation, such as financial statements, traffic reports, and legal contracts.

Here is the graph visualizing the time savings and success rates of using a business broker compared to selling independently.

Insights:

- Time Savings: Using a business broker can save approximately 70% of the time compared to selling independently, which only saves about 40%.

- Success Rates: The success rate for businesses sold through brokers is around 85%, significantly higher than the 50% success rate for those sold independently.

By leveraging the expertise and network of a business broker, sellers can achieve higher success rates and save valuable time during the sales process.

Choosing the right business broker for your needs

When selecting a business broker, it’s essential to evaluate their experience and specialization. Look for brokers who have a proven track record of successfully selling online businesses similar to yours. They should have a deep understanding of your industry and be familiar with the unique challenges and opportunities associated with your specific type of online business.

Understanding fee structures and services offered

Business brokers typically charge a commission based on the final sale price of the business. However, fee structures can vary, with some brokers charging upfront fees or offering tiered pricing based on the level of service provided. Be sure to clearly understand the broker’s fee structure and what services are included in their package. Some brokers may offer additional services, such as pre-sale preparation, marketing, and post-sale support, which can be valuable for sellers.

Checking references and reviews

Before engaging a business broker, take the time to check their references and reviews from past clients. Reach out to sellers who have previously worked with the broker and ask about their experience, the broker’s communication style, and their overall satisfaction with the sale process. Additionally, look for online reviews and testimonials to gauge the broker’s reputation in the industry.

By leveraging the expertise of a skilled business broker, sellers can streamline the sale process, maximize the value of their online business, and ensure a smooth transition to new ownership. As you explore the top online business-for-sale platforms, keep in mind the potential benefits of working with a broker to achieve your goals and protect your interests.

Navigating Website Marketplaces: Tips for Sellers and Buyers

TL;DR:

- Understand the nuances of top website marketplaces

- Learn strategies to optimize your listing and attract buyers

- Gain insights into buyer expectations and how to meet them

Top website marketplaces for buying and selling online businesses

When considering selling or buying an online business, it’s crucial to familiarize yourself with the top website marketplaces. Three notable platforms are Shopify Exchange, FE International, and Latona’s.

Shopify Exchange

Shopify Exchange is a marketplace dedicated to Shopify-based businesses. It offers a streamlined process for sellers to list their Shopify stores and for buyers to find established e-commerce businesses. The platform provides detailed store analytics, making it easier for buyers to assess the potential of a business. According to Shopify, their Exchange marketplace has facilitated over 10,000 store sales, with an average sale price of $25,000.

FE International

FE International is a leading market for buying and selling online businesses, including e-commerce stores, SaaS companies, and content websites. They offer a comprehensive valuation process and provide expert guidance throughout the transaction. FE International caters to a wide range of business sizes, from smaller starter stores to multi-million dollar acquisitions. FE International has facilitated over $1 billion in transactions since its inception.

Latona’s

Latona’s is another reputable marketplace that focuses on connecting buyers and sellers of online businesses. They specialize in e-commerce, SaaS, and content-based websites. Latona’s offers a personalized approach, assigning a dedicated broker to each listing to ensure a smooth transaction process. Latona’s has facilitated over 1,000 transactions, with a success rate of 95%.

Strategies for optimizing your listing and attracting buyers

To maximize your chances of a successful sale on these marketplaces, it’s essential to optimize your listing and present your business in the best possible light. Here are some key strategies:

Crafting a compelling business description

Your business description is the first thing potential buyers will see, so it’s crucial to make it engaging and informative. Highlight the unique aspects of your business, its target market, and its growth potential. Use clear, concise language and avoid industry jargon. For example, a compelling business description might look like this:

“Established e-commerce store specializing in eco-friendly products, with a strong brand presence and a loyal customer base. The business has seen consistent growth over the past three years, with a 25% increase in revenue in the last year alone. The store is fully integrated with Shopify, making it easy to manage and scale.”

Showcasing key metrics and unique selling points

Buyers are interested in the numbers behind your business. Showcase key metrics such as revenue, traffic, and customer base. Emphasize your business’s unique selling points, such as proprietary technology, strong brand presence, or a loyal customer base. Use visuals like graphs and charts to make the data more digestible. For instance, you could include a chart showing the growth in revenue over the past three years, highlighting the 25% increase in the last year.

Providing transparent financial data and growth potential

Transparency is key when selling a business. Provide detailed financial data, including profit and loss statements, cash flow projections, and a breakdown of revenue streams. Be honest about any challenges or areas for improvement. Highlight the growth potential of your business and back it up with data-driven projections. Ensure that you have accurate and up-to-date financial data before listing your business.

Preparing comprehensive documentation

Buyers appreciate well-organized documentation that provides a complete picture of the business. Prepare a detailed prospectus that includes an overview of your business model, marketing strategies, operational processes, and team structure. Include any relevant contracts, intellectual property documents, and financial statements. This comprehensive documentation will help build trust with potential buyers.

Being responsive and available for questions

Once your listing is live, be prepared to answer questions from potential buyers promptly. Respond to inquiries in a professional and transparent manner. Consider setting up a virtual data room where interested parties can access additional information about your business. Being responsive and available builds trust with potential buyers and can help accelerate the sale process.

Mastering the Due Diligence Process in Online Business Acquisitions

TL;DR:

- A thorough due diligence process is crucial for a successful online business acquisition

- Essential elements include verifying financials, analyzing traffic sources, and assessing supplier relationships

- Watch out for red flags like inconsistencies in reported revenue, overreliance on a single traffic source, and pending legal issues

Essential elements of a thorough due diligence checklist

When acquiring an online business, it’s critical to conduct a comprehensive due diligence process to ensure you’re making a sound investment. This process involves verifying financial statements and tax returns to confirm the business’s profitability and financial health. It’s important to review at least three years of financial data, including income statements, balance sheets, and cash flow statements.

Analyzing traffic sources and customer acquisition channels is another crucial aspect of due diligence. Understanding where the business’s traffic comes from and how it acquires customers can provide valuable insights into its sustainability and growth potential. Look for a diversified mix of traffic sources, such as organic search, paid advertising, social media, and email marketing.

Assessing supplier relationships and contracts

Assessing the strength of supplier relationships and contracts is also essential. Review all contracts with suppliers, manufacturers, and distributors to ensure they are in good standing and not set to expire soon. Evaluate the business’s reliance on key suppliers and assess the risk of supply chain disruptions.

Red flags to watch out for during due diligence

During the due diligence process, it’s crucial to be vigilant for potential red flags that could indicate issues with the online business. One major red flag is inconsistencies in reported revenue and expenses. If the financial statements don’t align with other data points, such as traffic or customer metrics, it could suggest misreporting or even fraud.

Overreliance on a single traffic source or customer is another red flag to watch out for. If the majority of the business’s revenue comes from one source, such as a single affiliate partnership or a small group of high-value customers, it could be a sign of vulnerability. Diversification is key to mitigating risk and ensuring long-term stability.

Legal issues and intellectual property disputes

Pending legal issues or intellectual property disputes are also significant red flags. Thoroughly review any ongoing or potential legal matters, such as customer complaints, vendor disputes, or copyright infringement claims. These issues could lead to costly legal battles or reputational damage down the line.

Importance of a comprehensive due diligence team

To ensure a thorough due diligence process, it’s essential to assemble a comprehensive team of experts. This team should include professionals with expertise in finance, accounting, legal, and the specific industry or niche of the online business being acquired.

For example, if you’re acquiring an e-commerce business, you may want to include team members with experience in supply chain management, inventory management, and digital marketing. If you’re acquiring a SaaS business, you’ll want experts in software development, user experience, and customer success.

Due diligence tools and resources

There are several tools and resources available to help streamline the due diligence process for online business acquisitions. Some popular options include:

- SaaS metrics dashboards like ChartMogul and ProfitWell for analyzing subscription-based businesses

- SEO tools like Ahrefs and SEMrush for evaluating organic traffic and keyword rankings

- Social media analytics tools like Sprout Social and Hootsuite for assessing social media presence and engagement

- Legal databases like LexisNexis and Westlaw for researching legal issues and intellectual property

Leveraging due diligence findings in negotiations

The findings from your due diligence process can be a powerful tool in negotiations with the seller. If you uncover any red flags or areas of concern, you can use this information to negotiate a lower purchase price or more favorable deal terms.

For example, if you discover that the business is overly reliant on a single traffic source, you may negotiate a lower valuation or request that the seller implement diversification strategies before the acquisition. Similarly, if there are pending legal issues, you may require the seller to resolve them before closing the deal or include indemnification clauses in the purchase agreement.

Post-acquisition integration planning

Due diligence isn’t just about identifying potential issues; it’s also about gathering the information needed to plan for a smooth post-acquisition integration. By thoroughly understanding the business’s operations, team structure, and key relationships, you can develop a detailed integration plan that minimizes disruption and maximizes synergies.

Some key elements to consider in your post-acquisition integration plan include:

- Aligning team structures and roles

- Integrating technology systems and data

- Consolidating vendor and supplier relationships

- Harmonizing company cultures and values

Decoding Valuation Methods for Online Businesses

- Understand the most common valuation methods for e-commerce and content businesses

- Learn how factors like niche, age, and growth potential impact valuations

- Discover advanced valuation techniques and resources for deeper analysis

Common valuation approaches for e-commerce and content-based businesses

When evaluating an online business for sale, buyers and sellers often rely on three primary valuation methods: Seller’s Discretionary Earnings (SDE) multiple, Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) multiple, and revenue multiple.

Seller’s Discretionary Earnings (SDE) multiple

SDE is a popular valuation method for smaller businesses, typically under $5 million in annual revenue. It calculates the total financial benefit the owner receives from the business, including salary, perks, and profits. The SDE multiple varies based on factors like business age, niche, and growth potential, but generally falls between 2-4x.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) multiple

For larger online businesses, EBITDA is the preferred valuation method. It measures a company’s operating profitability without considering non-operating expenses. Like SDE, the EBITDA multiple varies but typically ranges from 4-6x for established, profitable online businesses.

Revenue multiple and growth potential

While less common, some online businesses may be valued based on a revenue multiple, particularly if they demonstrate strong growth potential. This method is more speculative and depends heavily on the business’s niche, market demand, and scalability. Revenue multiples can range from 0.5-3x, with higher multiples awarded to businesses with exceptional growth prospects.

Factors that influence the valuation of an online business

Beyond the raw financial metrics, several key factors can significantly impact an online business’s valuation:

Niche and market demand

The niche in which an online business operates plays a crucial role in its valuation. Businesses in evergreen, high-demand niches like health, wellness, and personal finance often command higher multiples than those in more niche or trendy markets. Buyers are willing to pay a premium for businesses with a proven track record in stable, growing industries.

Age and stability of the business

Generally, older businesses with a consistent history of profitability are valued higher than younger, less established ones. Buyers perceive mature businesses as less risky, as they have weathered market fluctuations and proven their staying power. A business with 3+ years of stable or growing earnings will typically fetch a higher multiple than a newer business with a shorter track record.

Scalability and growth opportunities

Online businesses that demonstrate clear paths to growth and scalability are more attractive to buyers and command higher valuations. Factors like untapped marketing channels, expansion into new product lines or markets, and operational efficiencies can all contribute to a business’s growth potential. Buyers are often willing to pay more for a business they believe has room to grow and generate increased profits.

For a deeper dive into online business valuation, check out these resources:

- “The Ultimate Guide to Website Value” by Thomas Smale

- “How to Value a Website or Internet Business” by FE International

- “The SaaS Valuation Handbook” by Nathan Latka

By understanding the common valuation methods and key factors that influence online business valuations, buyers and sellers can approach transactions with greater confidence and clarity. But, valuation is just one piece of the puzzle – due diligence, deal structuring, and post-acquisition planning are all critical components of a successful online business acquisition.

Is Online Selling Still Profitable in 2024?

- E-commerce continues to grow, with global sales expected to reach $7.4 trillion by 2025.

- Mobile commerce and social selling are driving forces in the online selling landscape.

- Emerging niches and untapped markets offer new opportunities for online sellers.

Trends shaping the e-commerce landscape

The e-commerce industry has experienced significant growth over the past year, with the pandemic accelerating the shift towards online shopping. In 2024, global e-commerce sales are projected to reach $6.3 trillion, up from $5.5 trillion in 2023. This growth is driven by several key trends that are shaping the online selling landscape.

Rise of mobile commerce and social selling

Mobile commerce, or m-commerce, has become a dominant force in online selling. In 2024, mobile sales are expected to account for 54% of all e-commerce transactions, up from 50% in 2023. This growth is fueled by the increasing adoption of smartphones and the convenience of shopping on-the-go.

Social selling has also emerged as a key trend, with platforms like Instagram, Facebook, and TikTok becoming popular channels for online sellers. In 2024, social commerce sales are expected to reach $1.2 trillion, up from $992 billion in 2023.

Personalization and customer experience as key differentiators

As competition in the e-commerce space intensifies, personalization and customer experience have become crucial differentiators for online sellers. In 2024, businesses that invest in personalized marketing, product recommendations, and seamless customer journeys are more likely to succeed.

According to a recent survey, 80% of consumers are more likely to make a purchase from a brand that offers personalized experiences. Additionally, 73% of consumers say that customer experience is a key factor in their purchasing decisions.

Impact of artificial intelligence and automation on online selling

Artificial intelligence (AI) and automation are transforming the online selling landscape, enabling businesses to optimize their operations and deliver better customer experiences. In 2024, AI-powered chatbots, recommendation engines, and inventory management systems are becoming more widespread.

According to research by McKinsey, businesses that use AI-driven personalization can see a revenue increase of up to 15%. This improvement is driven by more tailored customer interactions that boost engagement and loyalty, ultimately leading to higher sales.

Additionally, AI-driven inventory management has been shown to substantially reduce stockouts by up to 50% and improve order accuracy by 25%. These advancements help businesses maintain better inventory levels, ensuring that products are available when customers need them and reducing errors in order fulfillment.

Emerging niches and untapped market opportunities

While e-commerce giants like Amazon and Alibaba continue to dominate the market, emerging niches and untapped market opportunities offer new avenues for online sellers to succeed in 2024.

Sustainable and eco-friendly products

As consumers become more environmentally conscious, the demand for sustainable and eco-friendly products is on the rise. In 2024, online sellers who offer products that align with these values are likely to attract a growing customer base.

According to a recent survey, 62% of consumers are willing to pay more for products from sustainable brands. Additionally, the global market for sustainable products is expected to reach $150 billion by 2025, up from $107 billion in 2020.

Health and wellness industry

The health and wellness industry has experienced significant growth in recent years, and this trend is expected to continue in 2024. Online sellers who offer products and services related to fitness, nutrition, mental health, and self-care are well-positioned to capitalize on this growing market.

The global wellness market is projected to reach $6.8 trillion by 2025, up from $4.9 trillion in 2020. Moreover, the online fitness market alone is expected to grow at a CAGR of 33.1% from 2021 to 2028.

Digital products and online courses

The demand for digital products and online courses has surged in recent years, driven by the growing need for remote learning and skill development. In 2024, online sellers who offer high-quality digital products and courses in popular niches like personal development, business, and technology are likely to thrive.

The global e-learning market is expected to reach $374 billion by 2026, up from $227 billion in 2020. Additionally, the market for digital products, such as ebooks, software, and templates, is projected to grow at a CAGR of 16.8% from 2021 to 2028.

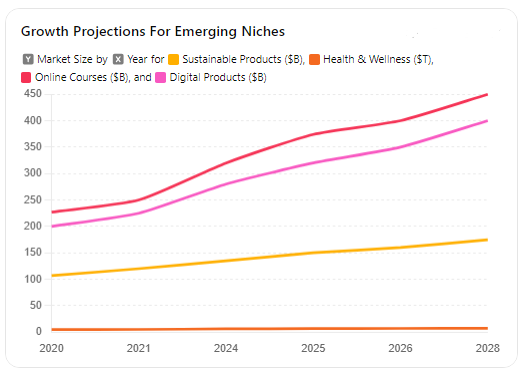

Growth Projections for Emerging Niches

Here is a table and graph illustrating the growth projections for the emerging niches mentioned:

Table: Growth Projections for Emerging Niches

| Year | Sustainable Products ($B) | Health & Wellness ($T) | Online Courses ($B) | Digital Products ($B) |

|---|---|---|---|---|

| 2020 | 107 | 4.9 | 227 | 200 |

| 2021 | 120 | 5.2 | 250 | 225 |

| 2024 | 135 | 6.2 | 320 | 280 |

| 2025 | 150 | 6.8 | 374 | 320 |

| 2026 | 160 | 7.1 | 400 | 350 |

| 2028 | 175 | 7.5 | 450 | 400 |

Graph: Growth Projections for Emerging Niches

The graph provides a visual representation of the projected growth for sustainable products, health and wellness, online courses, and digital products from 2020 to 2028.

As the e-commerce landscape continues to evolve, online sellers who stay attuned to these trends and opportunities are well-positioned to succeed in 2024 and beyond. By embracing mobile commerce, prioritizing personalization and customer experience, leveraging AI and automation, and exploring emerging niches, online sellers can navigate the competitive landscape and build thriving businesses.

Starting Your Own Online Selling Business: A Step-by-Step Guide

- Learn how to identify your niche, build a strong brand, and source products effectively

- Discover the best strategies for launching and promoting your online store

- Gain insights into effective inventory management and demand forecasting

Identifying your niche and target audience

Before diving into the world of online selling, it’s crucial to identify your niche and target audience. Start by conducting thorough market research and competitor analysis. Look for gaps in the market that your business can fill, and consider the unique value proposition you can offer to stand out from the competition.

Next, create buyer personas to better understand your ideal customers. Dive deep into their demographics, psychographics, and pain points. This information will help you tailor your products, marketing messages, and customer service to meet their specific needs and preferences.

Conducting market research and competitor analysis

- Analyze market trends and consumer behavior in your chosen niche

- Identify your main competitors and study their strengths and weaknesses

- Use tools like Google Trends, SEMrush, and Ahrefs to gather data on keywords, search volumes, and potential opportunities.

Defining your unique value proposition

- Determine what sets your business apart from competitors (e.g., product quality, customer service, sustainability)

- Craft a compelling value proposition that resonates with your target audience

- Ensure your unique selling points are clearly communicated across all marketing channels

Creating buyer personas and understanding their pain points

- Develop detailed profiles of your ideal customers, including demographics, interests, and shopping habits

- Identify the key challenges and pain points your target audience faces

- Use this information to create products and content that address their specific needs and desires.

Building your online presence and brand identity

With a clear understanding of your niche and target audience, it’s time to build your online presence and brand identity. Start by choosing the right e-commerce platform for your business. Popular options include Shopify and WooCommerce, both of which offer user-friendly interfaces and a wide range of customization options.

Next, focus on designing a visually appealing and user-friendly website. Ensure your site is optimized for conversions, with clear calls-to-action, easy navigation, and fast loading times. Don’t forget to develop a strong brand story and visual identity that resonates with your target audience and sets you apart from competitors.

Choosing the right e-commerce platform

- Compare the features, pricing, and scalability of popular e-commerce platforms like Shopify, WooCommerce, and Magento

- Consider your technical skills and budget when making a decision

- Look for platforms that offer robust security features, mobile responsiveness, and seamless integrations with other tools.

Designing a user-friendly website and optimizing for conversions

- Create a clean, intuitive layout that guides users through the buying process

- Use high-quality product images and detailed descriptions to showcase your offerings

- Implement fast loading times, mobile responsiveness, and secure checkout processes to reduce cart abandonment.

Developing a strong brand story and visual identity

- Define your brand’s mission, values, and personality

- Create a consistent visual identity across all touchpoints (e.g., logo, color scheme, typography)

- Craft compelling product descriptions and “About Us” pages that tell your brand story and connect with your target audience.

Sourcing products and managing inventory

One of the most critical aspects of running a successful online selling business is effectively sourcing products and managing inventory. Start by deciding between dropshipping, wholesale, or private label models. Each approach has its advantages and challenges, so consider your budget, time constraints, and long-term goals when making a decision.

Once you’ve chosen your sourcing method, focus on finding reliable suppliers and negotiating favorable terms. Build strong relationships with your suppliers to ensure consistent product quality and timely deliveries. Finally, implement robust inventory management systems and forecasting techniques to avoid stockouts and minimize holding costs.

Deciding between dropshipping, wholesale, or private label

- Research the pros and cons of each sourcing method in relation to your niche and target audience

- Consider factors like upfront costs, profit margins, branding control, and scalability when making a decision

- Choose a model that aligns with your long-term business goals and resources.

Finding reliable suppliers and negotiating terms

- Attend trade shows, search online directories, and leverage social media to find potential suppliers

- Vet suppliers thoroughly, checking for references, certifications, and product quality

- Negotiate favorable terms, including pricing, minimum order quantities, and payment terms.

Implementing inventory management systems and forecasting demand

- Use inventory management software to track stock levels, set reorder points, and automate purchase orders

- Implement demand forecasting techniques, such as time-series analysis and regression modeling, to predict future sales

- Regularly review and adjust your inventory strategy based on sales data, customer feedback, and market trends.

Launching and promoting your online store

With your online presence, brand identity, and product sourcing in place, it’s time to launch and promote your online store. Start by creating a pre-launch buzz and building an email list of potential customers. Use social media, content marketing, and paid advertising to drive traffic and generate interest in your products.

As you launch, focus on leveraging social media and influencer marketing to reach your target audience. Partner with influencers and micro-influencers in your niche to showcase your products and build trust with potential customers. Additionally, implement SEO best practices to improve your search engine rankings and attract organic traffic to your site.

Creating a pre-launch buzz and building an email list

- Create a “coming soon” landing page to capture email addresses and generate interest

- Offer exclusive discounts, free shipping, or other incentives to encourage signups

- Use social media and paid advertising to drive traffic to your pre-launch page.

Leveraging social media and influencer marketing

- Identify the social media platforms where your target audience is most active

- Create engaging, shareable content that showcases your products and brand story

- Partner with influencers and micro-influencers to create authentic, user-generated content and reach new audiences.

Implementing SEO best practices and running targeted ad campaigns

- Conduct keyword research to identify high-value, relevant keywords for your niche

- Optimize your website’s on-page elements, such as title tags, meta descriptions, and header tags, for target keywords

- Run targeted ad campaigns on platforms like Google Ads, Facebook Ads, and Instagram Ads to drive qualified traffic to your site.

By following these steps and consistently refining your strategies, you’ll be well on your way to building a thriving online selling business in 2024 and beyond. Remember to stay agile, adapt to market changes, and always prioritize customer satisfaction as you grow and scale your business.

The Ultimate Showdown: Comparing Top Online Business-for-Sale Platforms in 2024

In 2024, the online business-for-sale market is thriving, with several platforms competing to connect buyers and sellers. When choosing a platform, consider factors like reputation, user interface, and customer support. Flippa, BizBuySell, and Empire Flippers are among the leading contenders, each with unique features and benefits.

Business brokers play a crucial role in facilitating seamless transactions, offering expertise in valuation, access to qualified buyers, and handling negotiations. To find the right broker, evaluate their experience, fee structure, and client reviews.

Website marketplaces like Shopify Exchange, FE International, and Latona’s provide additional opportunities for buying and selling online businesses. Sellers can optimize their listings by crafting compelling descriptions, showcasing key metrics, and providing transparent financial data.

Comparison of Top Online Business-for-Sale Platforms

| Platform | Key Features | Pricing |

|---|---|---|

| Flippa | Large marketplace, auction-style listings, due diligence services | Listing fees from $49, Success fees from 10% |

| BizBuySell | Extensive listings, broker services, financing options | Free basic listings, Premium listings from $59.95, Broker fees |

| Empire Flippers | Curated listings, vetting process, migration assistance | Listing fee $297, Success fee 15% |

| Shopify Exchange | Exclusive to Shopify stores, easy listing creation, built-in analytics | Listing fees from $39, Success fees from 5% |

| FE International | M&A advisory, extensive due diligence, global reach | Custom pricing based on business value, Success fees from 15% |

| Latona’s | Focus on profitable online businesses, personalized service, confidentiality | Custom pricing, Success fees from 15% |

This table helps to identify the strengths and cost structures of each platform, aiding in the decision-making process for both buyers and sellers of online businesses.

Due diligence is essential for buyers, involving the verification of financial statements, analysis of traffic sources, and assessment of supplier relationships. Watch out for red flags like inconsistencies in reported revenue or overreliance on a single traffic source.

Valuation methods for online businesses include Seller’s Discretionary Earnings (SDE) multiple, EBITDA multiple, and revenue multiple. Factors influencing valuation include niche demand, business age, and growth potential.

Despite the challenges, online selling remains profitable in 2024, with trends like mobile commerce, personalization, and emerging niches offering untapped opportunities. By identifying your niche, building a strong online presence, sourcing products effectively, and implementing targeted marketing strategies, you can launch and grow a successful online selling business.

Discover Your Next Lever For Growth.

Every week, get an insider analysis of the largest eCom/Retail brands’ financials + a 3-Step Turnaround Plan for each biz. Your next growth opportunity is just an email away.

Join 4,210+ readers from Quip, Dr. Squatch, Jamby’s, Volcom and more.